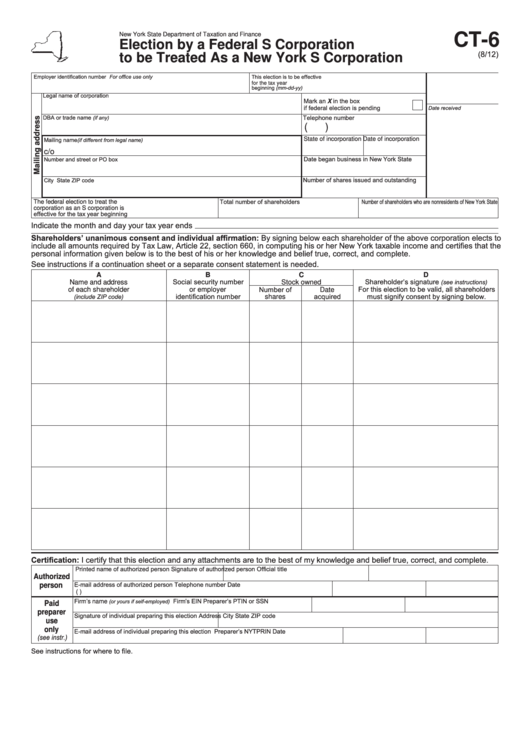

New York State Department of Taxation and Finance

CT-6

Election by a Federal S Corporation

(8/12)

to be Treated As a New York S Corporation

Employer identification number

This election is to be effective

For office use only

for the tax year

beginning (mm-dd-yy)

Legal name of corporation

Mark an X in the box

if federal election is pending .................

Date received

DBA or trade name

Telephone number

(if any)

(

)

Mailing name

State of incorporation Date of incorporation

(if different from legal name)

c/o

Date began business in New York State

Number and street or PO box

Number of shares issued and outstanding

City

State

ZIP code

Total number of shareholders

Number of shareholders who are nonresidents of New York State

The federal election to treat the

corporation as an S corporation is

effective for the tax year beginning

Indicate the month and day your tax year ends

Shareholders’ unanimous consent and individual affirmation: By signing below each shareholder of the above corporation elects to

include all amounts required by Tax Law, Article 22, section 660, in computing his or her New York taxable income and certifies that the

personal information given below is to the best of his or her knowledge and belief true, correct, and complete.

See instructions if a continuation sheet or a separate consent statement is needed.

A

B

C

D

Social security number

Shareholder’s signature

(see instructions)

Name and address

Stock owned

For this election to be valid, all shareholders

Number of

of each shareholder

or employer

Date

identification number

acquired

must signify consent by signing below.

(include ZIP code)

shares

Certification: I certify that this election and any attachments are to the best of my knowledge and belief true, correct, and complete.

Printed name of authorized person

Signature of authorized person

Official title

Authorized

E-mail address of authorized person

Telephone number

Date

person

(

)

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Firm’s name

Paid

preparer

Signature of individual preparing this election

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this election

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

1

1