Form Rpd-41238 - Application For Rural Job Tax Credit - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

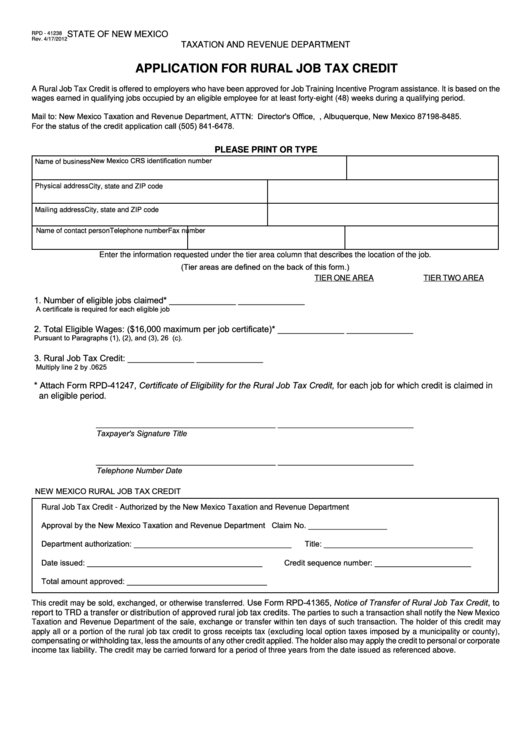

STATE OF NEW MEXICO

RPD - 41238

Rev. 4/17/2012

TAXATION AND REVENUE DEPARTMENT

APPLICATION FOR RURAL JOB TAX CREDIT

A Rural Job Tax Credit is offered to employers who have been approved for Job Training Incentive Program assistance. It is based on the

wages earned in qualifying jobs occupied by an eligible employee for at least forty-eight (48) weeks during a qualifying period.

Mail to: New Mexico Taxation and Revenue Department, ATTN: Director's Office, P.O. Box 8485, Albuquerque, New Mexico 87198-8485.

For the status of the credit application call (505) 841-6478.

PLEASE PRINT OR TYPE

New Mexico CRS identification number

Name of business

Physical address

City, state and ZIP code

Mailing address

City, state and ZIP code

Name of contact person

Telephone number

Fax number

Enter the information requested under the tier area column that describes the location of the job.

(Tier areas are defined on the back of this form.)

TIER ONE AREA

TIER TWO AREA

1. Number of eligible jobs claimed*

______________

______________

A certificate is required for each eligible job

2. Total Eligible Wages: ($16,000 maximum per job certificate)*

______________

______________

Pursuant to Paragraphs (1), (2), and (3), 26 U.S.C. Section 51(c).

3. Rural Job Tax Credit:

______________

______________

Multiply line 2 by .0625

* Attach Form RPD-41247, Certificate of Eligibility for the Rural Job Tax Credit, for each job for which credit is claimed in

an eligible period.

_________________________________________

_______________________________

Taxpayer's Signature

Title

_________________________________________

_______________________________

Telephone Number

Date

NEW MEXICO RURAL JOB TAX CREDIT

Rural Job Tax Credit - Authorized by the New Mexico Taxation and Revenue Department

Approval by the New Mexico Taxation and Revenue Department

Claim No. __________________

Department authorization: ____________________________________

Title: __________________________________

Date issued: ________________________________________

Credit sequence number: ______________________

Total amount approved: ________________________________

Use Form RPD-41365, Notice of Transfer of Rural Job Tax Credit, to

This credit may be sold, exchanged, or otherwise transferred.

report to TRD a transfer or distribution of approved rural job tax credits.

The parties to such a transaction shall notify the New Mexico

Taxation and Revenue Department of the sale, exchange or transfer within ten days of such transaction. The holder of this credit may

apply all or a portion of the rural job tax credit to gross receipts tax (excluding local option taxes imposed by a municipality or county),

compensating or withholding tax, less the amounts of any other credit applied. The holder also may apply the credit to personal or corporate

income tax liability. The credit may be carried forward for a period of three years from the date issued as referenced above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2