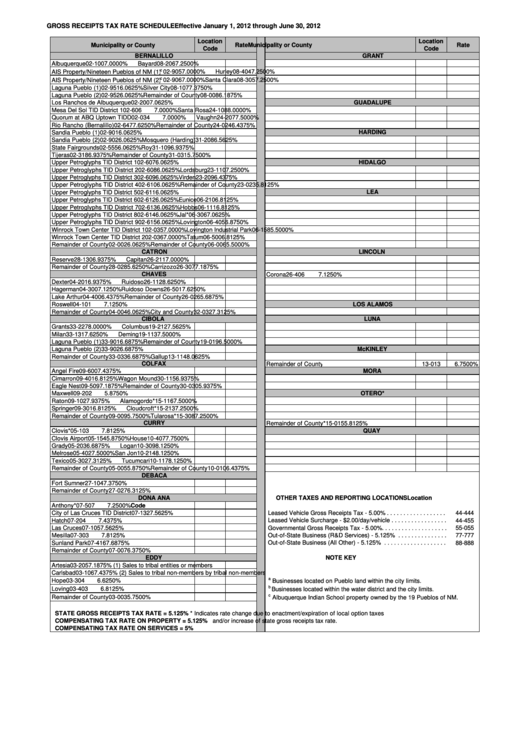

Gross Receipts Tax Rate Shedule - State Of New Mexico Taxation And Revenue Department - 2012

ADVERTISEMENT

GROSS RECEIPTS TAX RATE SCHEDULE

Effective January 1, 2012 through June 30, 2012

Location

Location

Municipality or County

Rate

Municipality or County

Rate

Code

Code

BERNALILLO

GRANT

Albuquerque

02-100

7.0000%

Bayard

08-206

7.2500%

c

02-905

7.0000%

Hurley

08-404

7.2500%

AIS Property/Nineteen Pueblos of NM (1)

c

02-906

7.0000%

Santa Clara

08-305

7.2500%

AIS Property/Nineteen Pueblos of NM (2)

Laguna Pueblo (1)

02-951

6.0625%

Silver City

08-107

7.3750%

Laguna Pueblo (2)

02-952

6.0625%

Remainder of County

08-008

6.1875%

Los Ranchos de Albuquerque

02-200

7.0625%

GUADALUPE

02-606

Mesa Del Sol TID District 1

7.0000%

Santa Rosa

24-108

8.0000%

Quorum at ABQ Uptown TIDD

02-034

7.0000%

Vaughn

24-207

7.5000%

Rio Rancho (Bernalillo)

02-647

7.6250%

Remainder of County

24-024

6.4375%

Sandia Pueblo (1)

02-901

6.0625%

HARDING

Sandia Pueblo (2)

02-902

6.0625%

Mosquero (Harding)

31-208

6.5625%

State Fairgrounds

02-555

6.0625%

Roy

31-109

6.9375%

Tijeras

02-318

6.9375%

Remainder of County

31-031

5.7500%

Upper Petroglyphs TID District 1

02-607

6.0625%

HIDALGO

Upper Petroglyphs TID District 2

02-608

6.0625%

Lordsburg

23-110

7.2500%

Upper Petroglyphs TID District 3

02-609

6.0625%

Virden

23-209

6.4375%

Upper Petroglyphs TID District 4

02-610

6.0625%

Remainder of County

23-023

5.8125%

Upper Petroglyphs TID District 5

02-611

6.0625%

LEA

Upper Petroglyphs TID District 6

02-612

6.0625%

Eunice

06-210

6.8125%

Upper Petroglyphs TID District 7

02-613

6.0625%

Hobbs

06-111

6.8125%

Upper Petroglyphs TID District 8

02-614

6.0625%

Jal*

06-306

7.0625%

Upper Petroglyphs TID District 9

02-615

6.0625%

Lovington

06-405

6.8750%

Winrock Town Center TID District 1

02-035

7.0000%

Lovington Industrial Park

06-158

5.5000%

Winrock Town Center TID District 2

02-036

7.0000%

Tatum

06-500

6.8125%

Remainder of County

02-002

6.0625%

Remainder of County

06-006

5.5000%

CATRON

LINCOLN

Reserve

28-130

6.9375%

Capitan

26-211

7.0000%

Remainder of County

28-028

5.6250%

Carrizozo

26-307

7.1875%

CHAVES

Corona

26-406

7.1250%

Dexter

04-201

6.9375%

Ruidoso

26-112

8.6250%

Hagerman

04-300

7.1250%

Ruidoso Downs

26-501

7.6250%

Lake Arthur

04-400

6.4375%

Remainder of County

26-026

5.6875%

Roswell

04-101

7.1250%

LOS ALAMOS

Remainder of County

04-004

6.0625%

City and County

32-032

7.3125%

CIBOLA

LUNA

Grants

33-227

8.0000%

Columbus

19-212

7.5625%

Milan

33-131

7.6250%

Deming

19-113

7.5000%

Laguna Pueblo (1)

33-901

6.6875%

Remainder of County

19-019

6.5000%

Laguna Pueblo (2)

33-902

6.6875%

McKINLEY

Remainder of County

33-033

6.6875%

Gallup

13-114

8.0625%

COLFAX

Remainder of County

13-013

6.7500%

Angel Fire

09-600

7.4375%

MORA

Cimarron

09-401

6.8125%

Wagon Mound

30-115

6.9375%

Eagle Nest

09-509

7.1875%

Remainder of County

30-030

5.9375%

Maxwell

09-202

5.8750%

OTERO*

Raton

09-102

7.9375%

Alamogordo*

15-116

7.5000%

Springer

09-301

6.8125%

Cloudcroft*

15-213

7.2500%

Remainder of County

09-009

5.7500%

Tularosa*

15-308

7.2500%

CURRY

Remainder of County*

15-015

5.8125%

QUAY

Clovis*

05-103

7.8125%

Clovis Airport

05-154

5.8750%

House

10-407

7.7500%

Grady

05-203

6.6875%

Logan

10-309

8.1250%

Melrose

05-402

7.5000%

San Jon

10-214

8.1250%

Texico

05-302

7.3125%

Tucumcari

10-117

8.1250%

Remainder of County

05-005

5.8750%

Remainder of County

10-010

6.4375%

DEBACA

Fort Sumner

27-104

7.3750%

Remainder of County

27-027

6.3125%

DONA ANA

OTHER TAXES AND REPORTING LOCATIONS

Location

Anthony*

07-507

7.2500%

Code

City of Las Cruces TID District

07-132

7.5625%

Leased Vehicle Gross Receipts Tax - 5.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44-444

Hatch

07-204

7.4375%

Leased Vehicle Surcharge - $2.00/day/vehicle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44-455

Las Cruces

07-105

7.5625%

Governmental Gross Receipts Tax - 5.00%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

55-055

Mesilla

07-303

7.8125%

Out-of-State Business (R&D Services) - 5.125% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

77-777

Sunland Park

07-416

7.6875%

Out-of-State Business (All Other) - 5.125% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

88-888

Remainder of County

07-007

6.3750%

EDDY

NOTE KEY

Artesia

03-205

7.1875%

(1) Sales to tribal entities or members

Carlsbad

03-106

7.4375%

(2) Sales to tribal non-members by tribal non-members

a

Hope

03-304

6.6250%

Businesses located on Pueblo land within the city limits.

b

Loving

03-403

6.8125%

Businesses located within the water district and the city limits.

c

Remainder of County

03-003

5.7500%

Albuquerque Indian School property owned by the 19 Pueblos of NM.

STATE GROSS RECEIPTS TAX RATE = 5.125%

* Indicates rate change due to enactment/expiration of local option taxes

and/or increase of state gross receipts tax rate.

COMPENSATING TAX RATE ON PROPERTY = 5.125%

COMPENSATING TAX RATE ON SERVICES = 5%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2