Form Ct-40 - Claim For Alternative Fuels Credit - New York State Department Of Taxation And Finance - 2012

ADVERTISEMENT

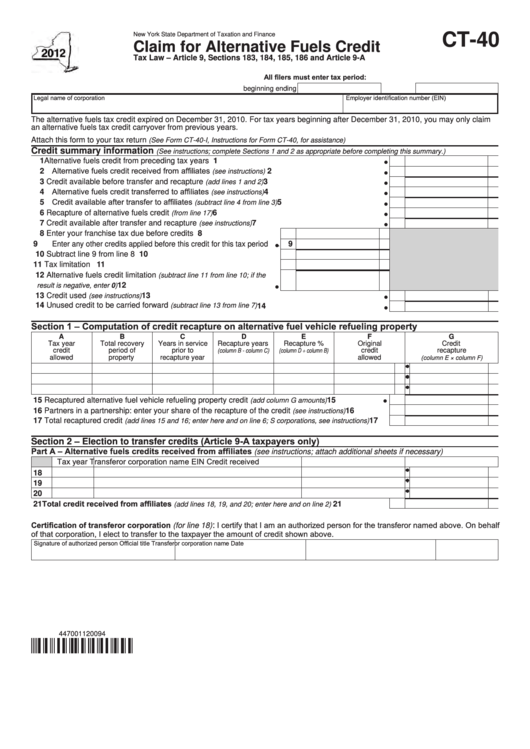

New York State Department of Taxation and Finance

CT‑40

Claim for Alternative Fuels Credit

Tax Law – Article 9, Sections 183, 184, 185, 186 and Article 9‑A

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

The alternative fuels tax credit expired on December 31, 2010. For tax years beginning after December 31, 2010, you may only claim

an alternative fuels tax credit carryover from previous years.

Attach this form to your tax return

(See Form CT-40-I, Instructions for Form CT-40, for assistance)

Credit summary information

(See instructions; complete Sections 1 and 2 as appropriate before completing this summary.)

1 Alternative fuels credit from preceding tax years ............................................................................

1

2 Alternative fuels credit received from affiliates

......................................................

2

(see instructions)

3 Credit available before transfer and recapture

....................................................

3

(add lines 1 and 2)

4 Alternative fuels credit transferred to affiliates

......................................................

4

(see instructions)

5 Credit available after transfer to affiliates

................................................

5

(subtract line 4 from line 3)

6 Recapture of alternative fuels credit

...........................................................................

6

(from line 17)

7 Credit available after transfer and recapture

.........................................................

7

(see instructions)

8 Enter your franchise tax due before credits ....................................

8

9 Enter any other credits applied before this credit for this tax period .

9

10 Subtract line 9 from line 8 ............................................................... 10

11 Tax limitation .................................................................................. 11

12 Alternative fuels credit limitation

(subtract line 11 from line 10; if the

..............................................................

12

result is negative, enter 0)

13 Credit used

............................................................................................................

13

(see instructions)

14 Unused credit to be carried forward

.......................................................

(subtract line 13 from line 7)

14

Section 1 – Computation of credit recapture on alternative fuel vehicle refueling property

A

B

C

D

E

F

G

Tax year

Total recovery

Years in service

Recapture years

Recapture %

Original

Credit

credit

period of

prior to

credit

recapture

(column B - column C)

(column D ÷ column B)

allowed

property

recapture year

allowed

(column E × column F)

15 Recaptured alternative fuel vehicle refueling property credit

........................

15

(add column G amounts)

16 Partners in a partnership: enter your share of the recapture of the credit

................. 16

(see instructions)

17 Total recaptured credit

....... 17

(add lines 15 and 16; enter here and on line 6; S corporations, see instructions)

Section 2 – Election to transfer credits (Article 9-A taxpayers only)

Part A – Alternative fuels credits received from affiliates

(see instructions; attach additional sheets if necessary)

Tax year

Transferor corporation name

EIN

Credit received

18

19

20

21 Total credit received from affiliates

..................... 21

(add lines 18, 19, and 20; enter here and on line 2)

Certification of transferor corporation (for line 18)

I certify that I am an authorized person for the transferor named above. On behalf

:

of that corporation, I elect to transfer to the taxpayer the amount of credit shown above.

Signature of authorized person

Official title

Transferor corporation name

Date

447001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2