Form Rpd-41298 - Research And Development Small Business Tax Credit Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

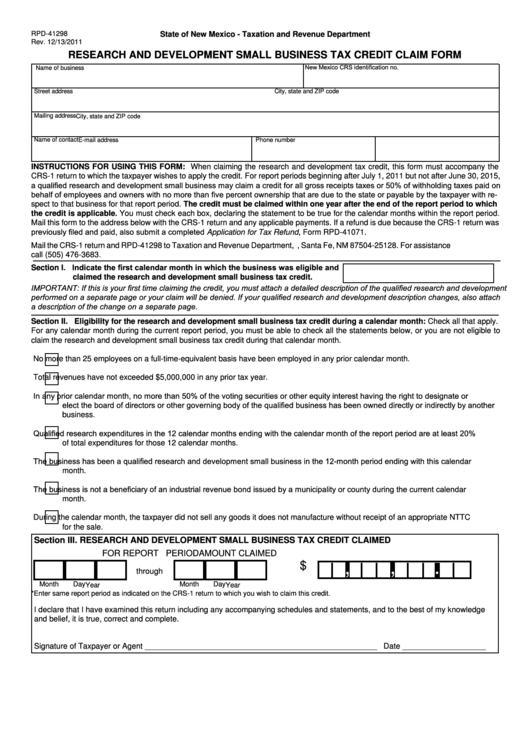

RPD-41298

State of New Mexico - Taxation and Revenue Department

Rev. 12/13/2011

RESEARCH AND DEVELOPMENT SMALL BUSINESS TAX CREDIT CLAIM FORM

New Mexico CRS identification no.

Name of business

Street address

City, state and ZIP code

Mailing address

City, state and ZIP code

Name of contact

Phone number

E-mail address

INSTRUCTIONS FOR USING THIS FORM: When claiming the research and development tax credit, this form must accompany the

CRS-1 return to which the taxpayer wishes to apply the credit. For report periods beginning after July 1, 2011 but not after June 30, 2015,

a qualified research and development small business may claim a credit for all gross receipts taxes or 50% of withholding taxes paid on

behalf of employees and owners with no more than five percent ownership that are due to the state or payable by the taxpayer with re-

spect to that business for that report period. The credit must be claimed within one year after the end of the report period to which

the credit is applicable. You must check each box, declaring the statement to be true for the calendar months within the report period.

Mail this form to the address below with the CRS-1 return and any applicable payments. If a refund is due because the CRS-1 return was

previously filed and paid, also submit a completed Application for Tax Refund, Form RPD-41071.

Mail the CRS-1 return and RPD-41298 to Taxation and Revenue Department, P.O. Box 25128, Santa Fe, NM 87504-25128. For assistance

call (505) 476-3683.

Section I. Indicate the first calendar month in which the business was eligible and

claimed the research and development small business tax credit.

IMPORTANT: If this is your first time claiming the credit, you must attach a detailed description of the qualified research and development

performed on a separate page or your claim will be denied. If your qualified research and development description changes, also attach

a description of the change on a separate page.

Section II. Eligibility for the research and development small business tax credit during a calendar month: Check all that apply.

For any calendar month during the current report period, you must be able to check all the statements below, or you are not eligible to

claim the research and development small business tax credit during that calendar month.

No more than 25 employees on a full-time-equivalent basis have been employed in any prior calendar month.

Total revenues have not exceeded $5,000,000 in any prior tax year.

In any prior calendar month, no more than 50% of the voting securities or other equity interest having the right to designate or

elect the board of directors or other governing body of the qualified business has been owned directly or indirectly by another

business.

Qualified research expenditures in the 12 calendar months ending with the calendar month of the report period are at least 20%

of total expenditures for those 12 calendar months.

The business has been a qualified research and development small business in the 12-month period ending with this calendar

month.

The business is not a beneficiary of an industrial revenue bond issued by a municipality or county during the current calendar

month.

During the calendar month, the taxpayer did not sell any goods it does not manufacture without receipt of an appropriate NTTC

for the sale.

Section III. RESEARCH AND DEVELOPMENT SMALL BUSINESS TAX CREDIT CLAIMED

FOR REPORT PERIOD

AMOUNT CLAIMED

,

,

.

$

through

Month

Day

Month

Day

Year

Year

*Enter same report period as indicated on the CRS-1 return to which you wish to claim this credit.

I declare that I have examined this return including any accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct and complete.

Signature of Taxpayer or Agent _____________________________________________________ Date ___________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2