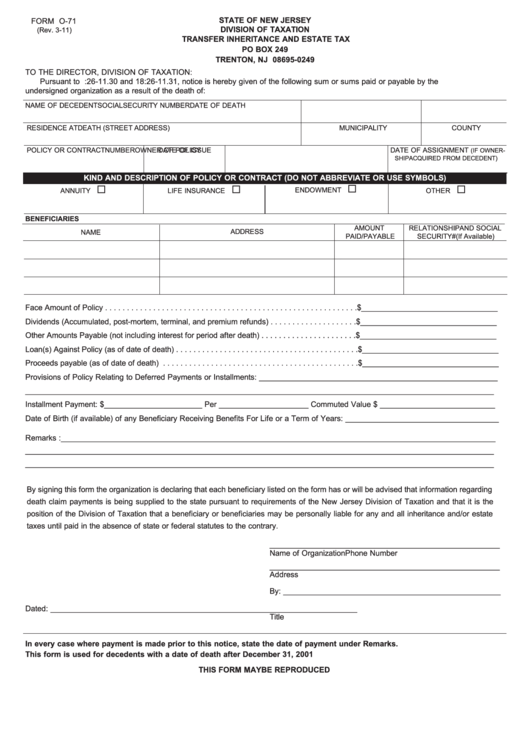

STATE OF NEW JERSEY

FORM O-71

DIVISION OF TAXATION

(Rev. 3-11)

TRANSFER INHERITANCE AND ESTATE TAX

PO BOX 249

TRENTON, NJ 08695-0249

TO THE DIRECTOR, DIVISION OF TAXATION:

Pursuant to N.J.A.C. 18:26-11.30 and 18:26-11.31, notice is hereby given of the following sum or sums paid or payable by the

undersigned organization as a result of the death of:

NAME OF DECEDENT

SOCIAL SECURITY NUMBER

DATE OF DEATH

RESIDENCE AT DEATH (STREET ADDRESS)

MUNICIPALITY

COUNTY

POLICY OR CONTRACT NUMBER

DATE OF ISSUE

OWNER OF POLICY

DATE OF ASSIGNMENT

(IF OWNER-

SHIP ACQUIRED FROM DECEDENT)

KIND AND DESCRIPTION OF POLICY OR CONTRACT (DO NOT ABBREVIATE OR USE SYMBOLS)

ENDOWMENT

ANNUITY

LIFE INSURANCE

OTHER

BENEFICIARIES

AMOUNT

RELATIONSHIP AND SOCIAL

ADDRESS

NAME

PAID/PAYABLE

SECURITY #(If Available)

Face Amount of Policy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ________________________________

Dividends (Accumulated, post-mortem, terminal, and premium refunds) . . . . . . . . . . . . . . . . . . . .$ ________________________________

Other Amounts Payable (not including interest for period after death) . . . . . . . . . . . . . . . . . . . . . .$ ________________________________

Loan(s) Against Policy (as of date of death) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ________________________________

Proceeds payable (as of date of death) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$ ________________________________

Provisions of Policy Relating to Deferred Payments or Installments: ________________________________________________________

______________________________________________________________________________________________________________

Installment Payment: $_______________________ Per _____________________ Commuted Value $ ___________________________

Date of Birth (if available) of any Beneficiary Receiving Benefits For Life or a Term of Years: ____________________________________

Remarks :______________________________________________________________________________________________________

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

By signing this form the organization is declaring that each beneficiary listed on the form has or will be advised that information regarding

death claim payments is being supplied to the state pursuant to requirements of the New Jersey Division of Taxation and that it is the

position of the Division of Taxation that a beneficiary or beneficiaries may be personally liable for any and all inheritance and/or estate

taxes until paid in the absence of state or federal statutes to the contrary.

______________________________________________________

Name of Organization

Phone Number

______________________________________________________

Address

By: ___________________________________________________

Dated: __________________

______________________________________________________

Title

In every case where payment is made prior to this notice, state the date of payment under Remarks.

This form is used for decedents with a date of death after December 31, 2001

THIS FORM MAY BE REPRODUCED

1

1 2

2