Instructions For Form 4947 - Schedule Of Certificated Credits

ADVERTISEMENT

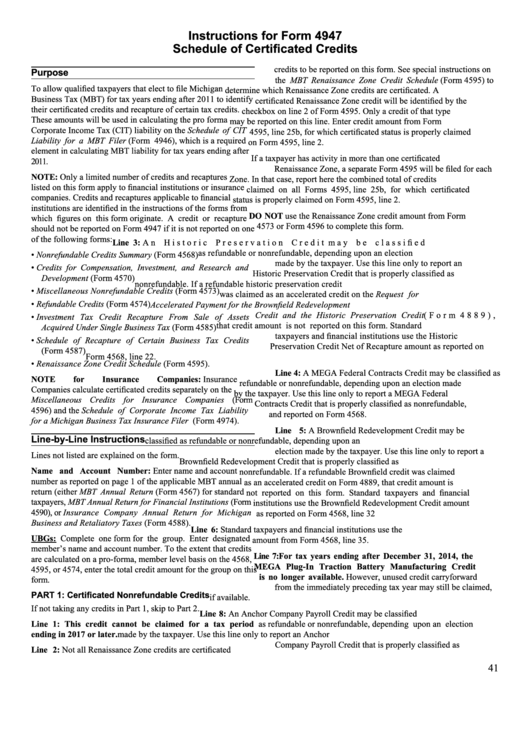

Instructions for Form 4947

Schedule of Certificated Credits

credits to be reported on this form. See special instructions on

Purpose

the MBT Renaissance Zone Credit Schedule (Form 4595) to

To allow qualified taxpayers that elect to file Michigan

determine which Renaissance Zone credits are certificated. A

Business Tax (MBT) for tax years ending after 2011 to identify

certificated Renaissance Zone credit will be identified by the

their certificated credits and recapture of certain tax credits.

checkbox on line 2 of Form 4595. Only a credit of that type

These amounts will be used in calculating the pro forma

may be reported on this line. Enter credit amount from Form

Corporate Income Tax (CIT) liability on the Schedule of CIT

4595, line 25b, for which certificated status is properly claimed

Liability for a MBT Filer (Form 4946), which is a required

on Form 4595, line 2.

element in calculating MBT liability for tax years ending after

If a taxpayer has activity in more than one certificated

2011.

Renaissance Zone, a separate Form 4595 will be filed for each

NOTE: Only a limited number of credits and recaptures

Zone. In that case, report here the combined total of credits

listed on this form apply to financial institutions or insurance

claimed on all Forms 4595, line 25b, for which certificated

companies. Credits and recaptures applicable to financial

status is properly claimed on Form 4595, line 2.

institutions are identified in the instructions of the forms from

DO NOT use the Renaissance Zone credit amount from Form

which figures on this form originate. A credit or recapture

4573 or Form 4596 to complete this form.

should not be reported on Form 4947 if it is not reported on one

of the following forms:

Line 3: An Historic Preservation Credit may be classified

as refundable or nonrefundable, depending upon an election

• Nonrefundable Credits Summary (Form 4568)

made by the taxpayer. Use this line only to report an

• Credits for Compensation, Investment, and Research and

Historic Preservation Credit that is properly classified as

Development (Form 4570)

nonrefundable. If a refundable historic preservation credit

• Miscellaneous Nonrefundable Credits (Form 4573)

was claimed as an accelerated credit on the Request for

• Refundable Credits (Form 4574)

Accelerated Payment for the Brownfield Redevelopment

Credit and the Historic Preservation Credit (Form 4889),

• Investment Tax Credit Recapture From Sale of Assets

that credit amount is not reported on this form. Standard

Acquired Under Single Business Tax (Form 4585)

taxpayers and financial institutions use the Historic

• Schedule of Recapture of Certain Business Tax Credits

Preservation Credit Net of Recapture amount as reported on

(Form 4587)

Form 4568, line 22.

• Renaissance Zone Credit Schedule (Form 4595).

Line 4: A MEGA Federal Contracts Credit may be classified as

NOTE

for

Insurance

Companies:

Insurance

refundable or nonrefundable, depending upon an election made

Companies calculate certificated credits separately on the

by the taxpayer. Use this line only to report a MEGA Federal

Miscellaneous Credits for Insurance Companies (Form

Contracts Credit that is properly classified as nonrefundable,

4596) and the Schedule of Corporate Income Tax Liability

and reported on Form 4568.

for a Michigan Business Tax Insurance Filer (Form 4974).

Line 5: A Brownfield Redevelopment Credit may be

Line-by-Line Instructions

classified as refundable or nonrefundable, depending upon an

election made by the taxpayer. Use this line only to report a

Lines not listed are explained on the form.

Brownfield Redevelopment Credit that is properly classified as

Name and Account Number: Enter name and account

nonrefundable. If a refundable Brownfield credit was claimed

number as reported on page 1 of the applicable MBT annual

as an accelerated credit on Form 4889, that credit amount is

return (either MBT Annual Return (Form 4567) for standard

not reported on this form. Standard taxpayers and financial

taxpayers, MBT Annual Return for Financial Institutions (Form

institutions use the Brownfield Redevelopment Credit amount

4590), or Insurance Company Annual Return for Michigan

as reported on Form 4568, line 32

Business and Retaliatory Taxes (Form 4588).

Line 6: Standard taxpayers and financial institutions use the

UBGs: Complete one form for the group. Enter designated

amount from Form 4568, line 35.

member’s name and account number. To the extent that credits

Line 7: For tax years ending after December 31, 2014, the

are calculated on a pro-forma, member level basis on the 4568,

MEGA Plug-In Traction Battery Manufacturing Credit

4595, or 4574, enter the total credit amount for the group on this

is no longer available. However, unused credit carryforward

form.

from the immediately preceding tax year may still be claimed,

PART 1: Certificated Nonrefundable Credits

if available.

If not taking any credits in Part 1, skip to Part 2.

Line 8: An Anchor Company Payroll Credit may be classified

Line 1: This credit cannot be claimed for a tax period

as refundable or nonrefundable, depending upon an election

ending in 2017 or later.

made by the taxpayer. Use this line only to report an Anchor

Company Payroll Credit that is properly classified as

Line 2: Not all Renaissance Zone credits are certificated

41

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5