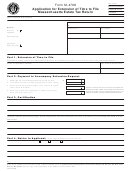

PROCEDURES FOR OBTAINING AN EXTENSION OF TIME

NOTE: This form can be filed electronically free of charge at apps.tn.gov/fnetax

1. Required Payment:

•

Payments equal to the lesser of 100% of the prior year tax liability or 90% of the current year tax liability

must be made by the original due date.

•

If the prior tax year covered less than twelve months, the prior period tax must be annualized when

calculating the required payment.

•

If there was no liability for the prior year, the required payment is $100.

•

Quarterly estimated payments, prior year overpayments and any other pre-payments should be deducted

on Line 3 of the worksheet.

2. Extension requests should be made as follows:

•

If you are not required to make a payment because you have already made sufficient payments, either

the state form or a copy of your federal extension request can be submitted. The form or copy of the

federal extension need not be filed on the original due date of the return. Instead, it should be attached to

the return itself, which is to be filed on or before the extended due date.

•

If a payment is needed to meet the payment requirement and you do not file your federal return as part of

a consolidated group, either the state form or a copy of your federal extension request can be submitted.

In this case, the form or copy of your federal extension must be filed with the extension payment on or

before the original due date of the return.

•

If a payment is required and you file your federal return as part of a consolidated group, you must use this

form or file an extension request electronically. This form or the electronic version of this form must be

filed with the extension payment on or before the original due date of the return.

3. Other important information:

•

Penalty will be computed as though no extension had been granted if, (1) the amount paid on or before

the original due date does not satisfy the payment requirement indicated above, or (2) the return is not

filed by the extended due date.

•

An approved extension does not affect interest. Interest will be computed on any unpaid tax from the

original due date of the return until the date the tax is paid.

INTERNET (5-12)

1

1 2

2