Instructions For Form Part-200-T - 2011

ADVERTISEMENT

__________________________________________2011 Form 1065 _______________________________________ 17

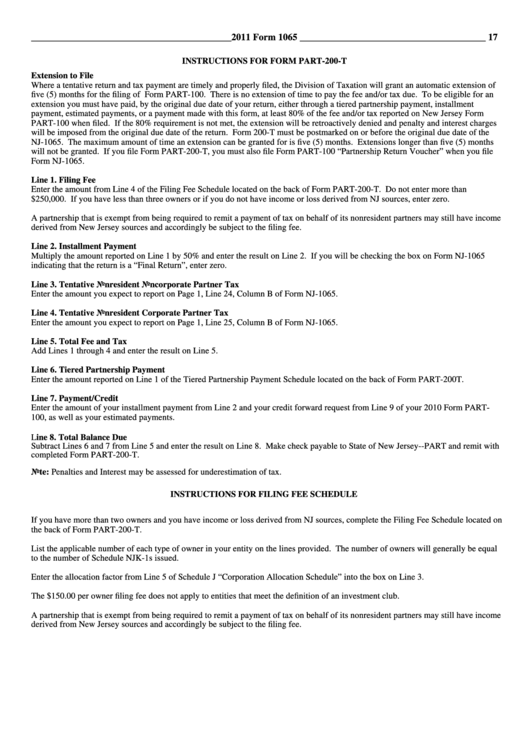

INSTRUCTIONS FOR FORM PART-200-T

Extension to File

Where a tentative return and tax payment are timely and properly filed, the Division of Taxation will grant an automatic extension of

five (5) months for the filing of Form PART-100. There is no extension of time to pay the fee and/or tax due. To be eligible for an

extension you must have paid, by the original due date of your return, either through a tiered partnership payment, installment

payment, estimated payments, or a payment made with this form, at least 80% of the fee and/or tax reported on New Jersey Form

PART-100 when filed. If the 80% requirement is not met, the extension will be retroactively denied and penalty and interest charges

will be imposed from the original due date of the return. Form 200-T must be postmarked on or before the original due date of the

NJ-1065. The maximum amount of time an extension can be granted for is five (5) months. Extensions longer than five (5) months

will not be granted. If you file Form PART-200-T, you must also file Form PART-100 “Partnership Return Voucher” when you file

Form NJ-1065.

Line 1. Filing Fee

Enter the amount from Line 4 of the Filing Fee Schedule located on the back of Form PART-200-T. Do not enter more than

$250,000. If you have less than three owners or if you do not have income or loss derived from NJ sources, enter zero.

A partnership that is exempt from being required to remit a payment of tax on behalf of its nonresident partners may still have income

derived from New Jersey sources and accordingly be subject to the filing fee.

Line 2. Installment Payment

Multiply the amount reported on Line 1 by 50% and enter the result on Line 2. If you will be checking the box on Form NJ-1065

indicating that the return is a “Final Return”, enter zero.

Line 3. Tentative Nonresident Noncorporate Partner Tax

Enter the amount you expect to report on Page 1, Line 24, Column B of Form NJ-1065.

Line 4. Tentative Nonresident Corporate Partner Tax

Enter the amount you expect to report on Page 1, Line 25, Column B of Form NJ-1065.

Line 5. Total Fee and Tax

Add Lines 1 through 4 and enter the result on Line 5.

Line 6. Tiered Partnership Payment

Enter the amount reported on Line 1 of the Tiered Partnership Payment Schedule located on the back of Form PART-200T.

Line 7. Payment/Credit

Enter the amount of your installment payment from Line 2 and your credit forward request from Line 9 of your 2010 Form PART-

100, as well as your estimated payments.

Line 8. Total Balance Due

Subtract Lines 6 and 7 from Line 5 and enter the result on Line 8. Make check payable to State of New Jersey--PART and remit with

completed Form PART-200-T.

Note:

Penalties and Interest may be assessed for underestimation of tax.

INSTRUCTIONS FOR FILING FEE SCHEDULE

If you have more than two owners and you have income or loss derived from NJ sources, complete the Filing Fee Schedule located on

the back of Form PART-200-T.

List the applicable number of each type of owner in your entity on the lines provided. The number of owners will generally be equal

to the number of Schedule NJK-1s issued.

Enter the allocation factor from Line 5 of Schedule J “Corporation Allocation Schedule” into the box on Line 3.

The $150.00 per owner filing fee does not apply to entities that meet the definition of an investment club.

A partnership that is exempt from being required to remit a payment of tax on behalf of its nonresident partners may still have income

derived from New Jersey sources and accordingly be subject to the filing fee.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1