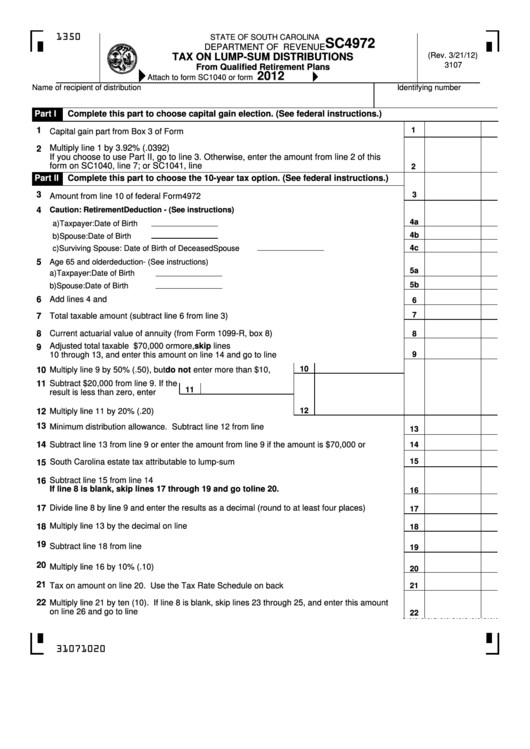

1350

STATE OF SOUTH CAROLINA

SC4972

DEPARTMENT OF REVENUE

(Rev. 3/21/12)

TAX ON LUMP-SUM DISTRIBUTIONS

3107

From Qualified Retirement Plans

2012

Attach to form SC1040 or form SC1041.

See federal instructions.

Name of recipient of distribution

Identifying number

Part I

Complete this part to choose capital gain election. (See federal instructions.)

1

1

Capital gain part from Box 3 of Form 1099-R...............................................................................

Multiply line 1 by 3.92% (.0392)

2

If you choose to use Part II, go to line 3. Otherwise, enter the amount from line 2 of this

form on SC1040, line 7; or SC1041, line 9............................................................................

2

Part II

Complete this part to choose the 10-year tax option. (See federal instructions.)

3

3

Amount from line 10 of federal Form 4972 .................................................................................

4

Caution: Retirement Deduction - (See instructions)

4a

a) Taxpayer: Date of Birth

4b

b) Spouse:

Date of Birth

4c

c) Surviving Spouse: Date of Birth of Deceased Spouse

5

Age 65 and older deduction - (See instructions )

5a

a) Taxpayer: Date of Birth

5b

b) Spouse:

Date of Birth

6

Add lines 4 and 5.........................................................................................................................

6

7

7

Total taxable amount (subtract line 6 from line 3) .......................................................................

Current actuarial value of annuity (from Form 1099-R, box 8) ....................................................

8

8

Adjusted total taxable amount. Add lines 7 and 8. If this amount is $70,000 or more, skip lines

9

10 through 13, and enter this amount on line 14 and go to line 15...............................................

9

10

10

Multiply line 9 by 50% (.50), but do not enter more than $10,000...

11

Subtract $20,000 from line 9. If the

11

result is less than zero, enter -0-....

12

12

Multiply line 11 by 20% (.20)...........................................................

13

Minimum distribution allowance. Subtract line 12 from line 10....................................................

13

14

Subtract line 13 from line 9 or enter the amount from line 9 if the amount is $70,000 or more....

14

South Carolina estate tax attributable to lump-sum distribution...................................................

15

15

Subtract line 15 from line 14

16

If line 8 is blank, skip lines 17 through 19 and go to line 20..................................................

16

17

Divide line 8 by line 9 and enter the results as a decimal (round to at least four places) .............

17

Multiply line 13 by the decimal on line 17.....................................................................................

18

18

19

Subtract line 18 from line 8...........................................................................................................

19

20

Multiply line 16 by 10% (.10).........................................................................................................

20

21

Tax on amount on line 20. Use the Tax Rate Schedule on back ................................................

21

22

Multiply line 21 by ten (10). If line 8 is blank, skip lines 23 through 25, and enter this amount

on line 26 and go to line 27...........................................................................................................

22

31071020

1

1 2

2