Form Sc Sch.tc-50 - Biomass Resource Credit

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

SC SCH.TC-50

DEPARTMENT OF REVENUE

BIOMASS RESOURCE

(Rev. 6/07/10)

3440

CREDIT

Attach to your Income Tax Return

20

FEIN

Name As Shown On Tax Return

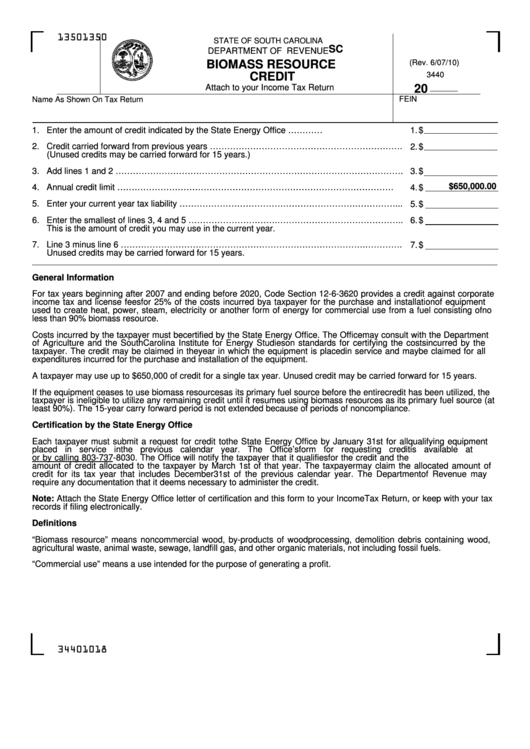

1. Enter the amount of credit indicated by the State Energy Office ………….................................

1.

$

2. Credit carried forward from previous years ………………………………………………………….

2.

$

(Unused credits may be carried forward for 15 years.)

3. Add lines 1 and 2 ……………………………………………………………………………………….

3.

$

$650,000.00

4. Annual credit limit ……………………………………………………………………………………....

4.

$

5. Enter your current year tax liability …………………………………………………………………...

5.

$

6. Enter the smallest of lines 3, 4 and 5 ………………………….……………………………………..

6.

$

This is the amount of credit you may use in the current year.

7. Line 3 minus line 6 ………………………………………………………………………….………….

7.

$

Unused credits may be carried forward for 15 years.

General Information

For tax years beginning after 2007 and ending before 2020, Code Section 12-6-3620 provides a credit against corporate

income tax and license fees for 25% of the costs incurred by a taxpayer for the purchase and installation of equipment

used to create heat, power, steam, electricity or another form of energy for commercial use from a fuel consisting of no

less than 90% biomass resource.

Costs incurred by the taxpayer must be certified by the State Energy Office. The Office may consult with the Department

of Agriculture and the South Carolina Institute for Energy Studies on standards for certifying the costs incurred by the

taxpayer. The credit may be claimed in the year in which the equipment is placed in service and may be claimed for all

expenditures incurred for the purchase and installation of the equipment.

A taxpayer may use up to $650,000 of credit for a single tax year. Unused credit may be carried forward for 15 years.

If the equipment ceases to use biomass resources as its primary fuel source before the entire credit has been utilized, the

taxpayer is ineligible to utilize any remaining credit until it resumes using biomass resources as its primary fuel source (at

least 90%). The 15-year carry forward period is not extended because of periods of noncompliance.

Certification by the State Energy Office

Each taxpayer must submit a request for credit to the State Energy Office by January 31st for all qualifying equipment

placed in service in the previous calendar year. The Office’s form for requesting credit is available at

or by calling 803-737-8030. The Office will notify the taxpayer that it qualifies for the credit and the

amount of credit allocated to the taxpayer by March 1st of that year. The taxpayer may claim the allocated amount of

credit for its tax year that includes December 31st of the previous calendar year. The Department of Revenue may

require any documentation that it deems necessary to administer the credit.

Note: Attach the State Energy Office letter of certification and this form to your Income Tax Return, or keep with your tax

records if filing electronically.

Definitions

“Biomass resource” means noncommercial wood, by-products of wood processing, demolition debris containing wood,

agricultural waste, animal waste, sewage, landfill gas, and other organic materials, not including fossil fuels.

“Commercial use” means a use intended for the purpose of generating a profit.

34401018

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1