Form Sc Sch.tc-3 - Water Resources Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-3

DEPARTMENT OF REVENUE

(Rev. 6/7/10)

WATER RESOURCES CREDIT

3116

Attach this form to your return.

20

Name

SSN or FEIN

Address

Location of Property

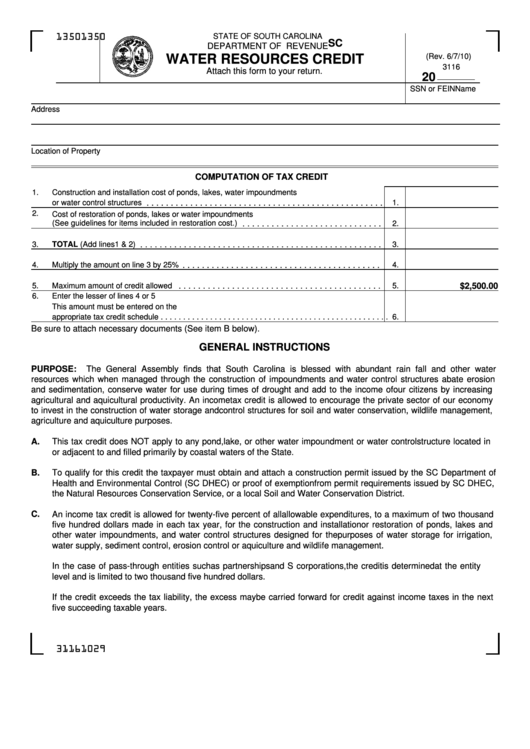

COMPUTATION OF TAX CREDIT

1.

Construction and installation cost of ponds, lakes, water impoundments

or water control structures

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Cost of restoration of ponds, lakes or water impoundments

(See guidelines for items included in restoration cost.)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

TOTAL (Add lines 1 & 2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Multiply the amount on line 3 by 25%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$2,500.00

5.

Maximum amount of credit allowed

5.

6.

Enter the lesser of lines 4 or 5

This amount must be entered on the

appropriate tax credit schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

Be sure to attach necessary documents (See item B below).

GENERAL INSTRUCTIONS

PURPOSE:

The General Assembly finds that South Carolina is blessed with abundant rain fall and other water

resources which when managed through the construction of impoundments and water control structures abate erosion

and sedimentation, conserve water for use during times of drought and add to the income of our citizens by increasing

agricultural and aquicultural productivity. An income tax credit is allowed to encourage the private sector of our economy

to invest in the construction of water storage and control structures for soil and water conservation, wildlife management,

agriculture and aquiculture purposes.

A.

This tax credit does NOT apply to any pond, lake, or other water impoundment or water control structure located in

or adjacent to and filled primarily by coastal waters of the State.

B.

To qualify for this credit the taxpayer must obtain and attach a construction permit issued by the SC Department of

Health and Environmental Control (SC DHEC) or proof of exemption from permit requirements issued by SC DHEC,

the Natural Resources Conservation Service, or a local Soil and Water Conservation District.

C.

An income tax credit is allowed for twenty-five percent of all allowable expenditures, to a maximum of two thousand

five hundred dollars made in each tax year, for the construction and installation or restoration of ponds, lakes and

other water impoundments, and water control structures designed for the purposes of water storage for irrigation,

water supply, sediment control, erosion control or aquiculture and wildlife management.

In the case of pass-through entities such as partnerships and S corporations, the credit is determined at the entity

level and is limited to two thousand five hundred dollars.

If the credit exceeds the tax liability, the excess may be carried forward for credit against income taxes in the next

five succeeding taxable years.

31161029

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2