Form Sc Sch.tc-43 - Residential Retrofit Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-43

DEPARTMENT OF REVENUE

RESIDENTIAL RETROFIT

(Rev. 7/8/11)

3437

CREDIT

20

Attach to your Income Tax Return

Names As Shown On Tax Return

SS No.

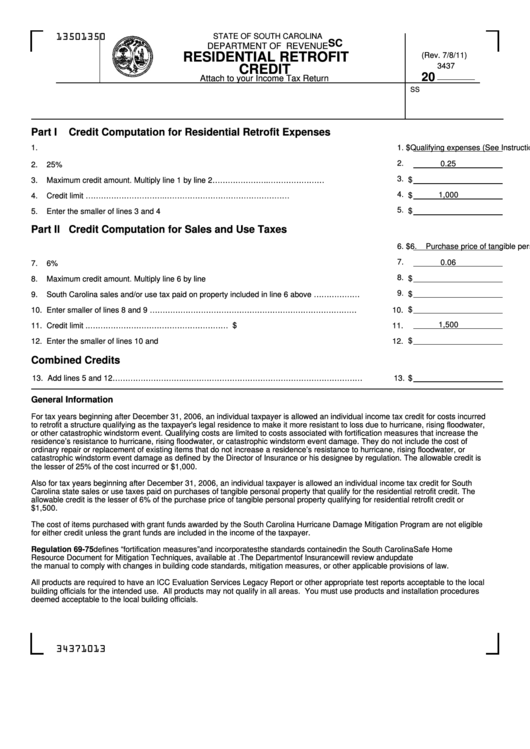

Part I

Credit Computation for Residential Retrofit Expenses

1.

Qualifying expenses (See Instructions)................................................................................................

1.

$

2.

0.25

2.

25%......................................................................................................................................................

3.

3.

Maximum credit amount. Multiply line 1 by line 2…………………..………………….............................

$

4.

1,000

4.

Credit limit …………………………..………………………………………….............................................

$

5.

5.

Enter the smaller of lines 3 and 4 ........................................................................................................

$

Part II Credit Computation for Sales and Use Taxes

6.

Purchase price of tangible personal property included in line 1 above.................................................

6.

$

7.

0.06

7.

6% .......................................................................................................................................................

8.

$

8.

Maximum credit amount. Multiply line 6 by line 7.................................................................................

9.

$

9.

South Carolina sales and/or use tax paid on property included in line 6 above ……………….............

$

10. Enter smaller of lines 8 and 9 ………………………………………………………………………..............

10.

1,500

$

11. Credit limit ..……………………………………………….........................................................................

11.

$

12. Enter the smaller of lines 10 and 11.....................................................................................................

12.

Combined Credits

13. Add lines 5 and 12………………………..……………………………………………………………...........

13.

$

General Information

For tax years beginning after December 31, 2006, an individual taxpayer is allowed an individual income tax credit for costs incurred

to retrofit a structure qualifying as the taxpayer's legal residence to make it more resistant to loss due to hurricane, rising floodwater,

or other catastrophic windstorm event. Qualifying costs are limited to costs associated with fortification measures that increase the

residence’s resistance to hurricane, rising floodwater, or catastrophic windstorm event damage. They do not include the cost of

ordinary repair or replacement of existing items that do not increase a residence’s resistance to hurricane, rising floodwater, or

catastrophic windstorm event damage as defined by the Director of Insurance or his designee by regulation. The allowable credit is

the lesser of 25% of the cost incurred or $1,000.

Also for tax years beginning after December 31, 2006, an individual taxpayer is allowed an individual income tax credit for South

Carolina state sales or use taxes paid on purchases of tangible personal property that qualify for the residential retrofit credit. The

allowable credit is the lesser of 6% of the purchase price of tangible personal property qualifying for residential retrofit credit or

$1,500.

The cost of items purchased with grant funds awarded by the South Carolina Hurricane Damage Mitigation Program are not eligible

for either credit unless the grant funds are included in the income of the taxpayer.

Regulation 69-75 defines “fortification measures” and incorporates the standards contained in the South Carolina Safe Home

Resource Document for Mitigation Techniques, available at The Department of Insurance will review and update

the manual to comply with changes in building code standards, mitigation measures, or other applicable provisions of law.

All products are required to have an ICC Evaluation Services Legacy Report or other appropriate test reports acceptable to the local

building officials for the intended use. All products may not qualify in all areas. You must use products and installation procedures

deemed acceptable to the local building officials.

34371013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2