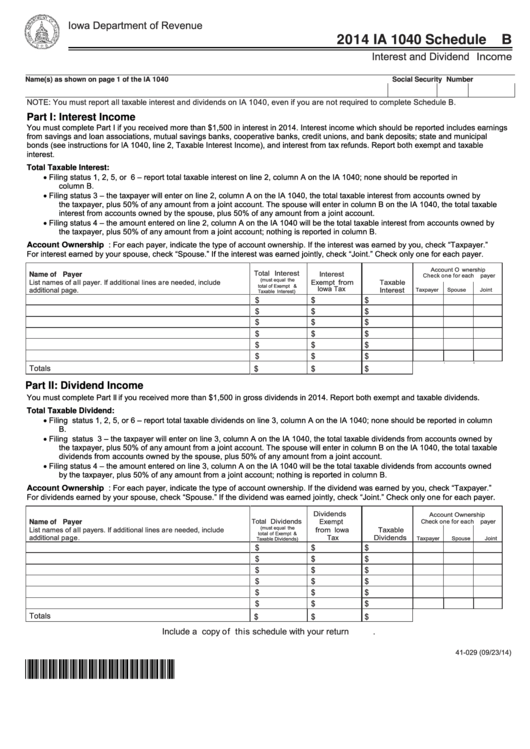

Iowa Department of Revenue

2014 IA 1040 Schedule B

Interest and Dividend Income

Name(s) as shown on page 1 of the IA 1040

Social Security Number

NOTE: You must report all taxable interest and dividends on IA 1040, even if you are not required to complete Schedule B.

Part I: Interest Income

You must complete Part I if you received more than $1,500 in interest in 2014. Interest income which should be reported includes earnings

from savings and loan associations, mutual savings banks, cooperative banks, credit unions, and bank deposits; state and municipal

bonds (see instructions for IA 1040, line 2, Taxable Interest Income), and interest from tax refunds. Report both exempt and taxable

interest.

Total Taxable Interest:

Filing status 1, 2, 5, or 6 – report total taxable interest on line 2, column A on the IA 1040; none should be reported in

column B.

Filing status 3 – the taxpayer will enter on line 2, column A on the IA 1040, the total taxable interest from accounts owned by

the taxpayer, plus 50% of any amount from a joint account. The spouse will enter in column B on the IA 1040, the total taxable

interest from accounts owned by the spouse, plus 50% of any amount from a joint account.

Filing status 4 – the amount entered on line 2, column A on the IA 1040 will be the total taxable interest from accounts owned by

the taxpayer, plus 50% of any amount from a joint account; nothing is reported in column B.

Account Ownership: For each payer, indicate the type of account ownership. If the interest was earned by you, check “Taxpayer.”

For interest earned by your spouse, check “Spouse.” If the interest was earned jointly, check “Joint.” Check only one for each payer.

Account Ownership

Total Interest

Interest

Name of Payer

Check one for each payer

List names of all payer. If additional lines are needed, include

(must equal the

Exempt from

Taxable

total of Exempt &

additional page.

Iowa Tax

Interest

Taxpayer

Spouse

Joint

Taxable Interest)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Totals

$

$

$

Part II: Dividend Income

You must complete Part II if you received more than $1,500 in gross dividends in 2014. Report both exempt and taxable dividends.

Total Taxable Dividend:

Filing status 1, 2, 5, or 6 – report total taxable dividends on line 3, column A on the IA 1040; none should be reported in column

B.

Filing status 3 – the taxpayer will enter on line 3, column A on the IA 1040, the total taxable dividends from accounts owned by

the taxpayer, plus 50% of any amount from a joint account. The spouse will enter in column B on the IA 1040, the total taxable

dividends from accounts owned by the spouse, plus 50% of any amount from a joint account.

Filing status 4 – the amount entered on line 3, column A on the IA 1040 will be the total taxable dividends from accounts owned

by the taxpayer, plus 50% of any amount from a joint account; nothing is reported in column B.

Account Ownership: For each payer, indicate the type of account ownership. If the dividend was earned by you, check “Taxpayer.”

For dividends earned by your spouse, check “Spouse.” If the dividend was earned jointly, check “Joint.” Check only one for each payer.

Dividends

Account Ownership

Total Dividends

Exempt

Check one for each payer

Name of Payer

(must equal the

List names of all payers. If additional lines are needed, include

from Iowa

Taxable

total of Exempt &

additional page.

Tax

Dividends

Taxpayer

Spouse

Joint

Taxable Dividends)

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Totals

$

$

$

Include a copy of this schedule w i t h your return.

41-029 (09/23/14)

*1441004029999*

1

1