Certified Visual Media Production Credit Worksheet - 2011

ADVERTISEMENT

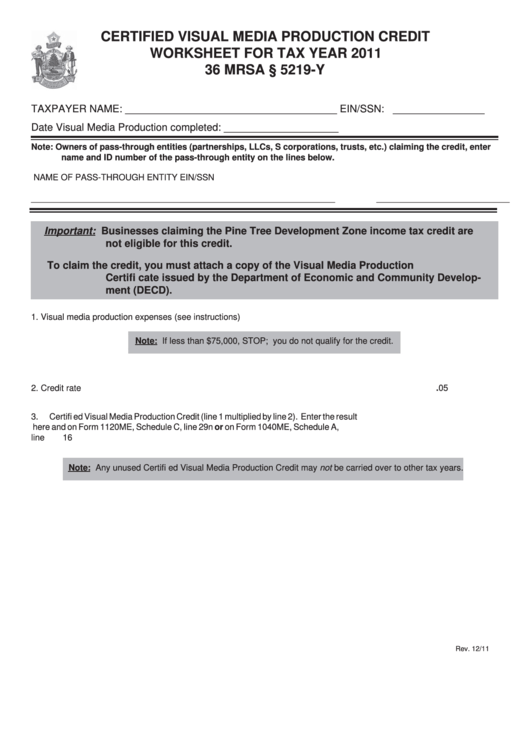

CERTIFIED VISUAL MEDIA PRODUCTION CREDIT

WORKSHEET FOR TAX YEAR 2011

36 MRSA § 5219-Y

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Date Visual Media Production completed: ____________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) claiming the credit, enter

name and ID number of the pass-through entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Important: Businesses claiming the Pine Tree Development Zone income tax credit are

not eligible for this credit.

To claim the credit, you must attach a copy of the Visual Media Production

Certifi cate issued by the Department of Economic and Community Develop-

ment (DECD).

1.

Visual media production expenses (see instructions) ....................................................... 1. ____________________

Note: If less than $75,000, STOP; you do not qualify for the credit.

2.

Credit rate ......................................................................................................................... 2. ____________________

.05

3.

Certifi ed Visual Media Production Credit (line 1 multiplied by line 2). Enter the result

here and on Form 1120ME, Schedule C, line 29n or on Form 1040ME, Schedule A,

line 16 ................................................................................................................................ 3. ____________________

Note: Any unused Certifi ed Visual Media Production Credit may not be carried over to other tax years.

Rev. 12/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2