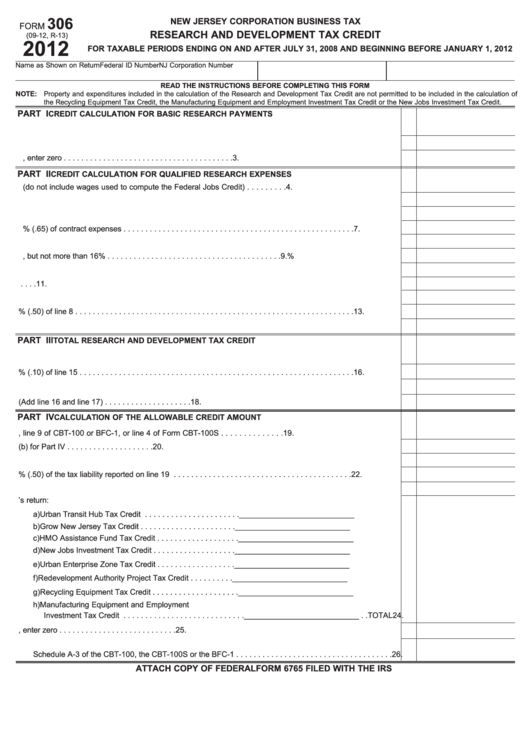

306

NEW JERSEY CORPORATION BUSINESS TAX

FORM

RESEARCH AND DEVELOPMENT TAX CREDIT

(09-12, R-13)

2012

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 31, 2008 AND BEGINNING BEFORE JANUARY 1, 2012

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

NOTE: Property and expenditures included in the calculation of the Research and Development Tax Credit are not permitted to be included in the calculation of

the Recycling Equipment Tax Credit, the Manufacturing Equipment and Employment Investment Tax Credit or the New Jobs Investment Tax Credit.

PART I

CREDIT CALCULATION FOR BASIC RESEARCH PAYMENTS

1. Enter the basic research payments paid or incurred to qualified organizations . . . . . . . . . . . . . . . . . . . . .

1.

2. Enter the base period amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Subtract line 2 from line 1. If less than zero, enter zero . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

PART II

CREDIT CALCULATION FOR QUALIFIED RESEARCH EXPENSES

4. Wages for qualified services (do not include wages used to compute the Federal Jobs Credit) . . . . . . . . .

4.

5. Cost of supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Rental or lease costs of computers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Enter 65% (.65) of contract expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Total qualified research expenses - Add lines 4 through 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Enter fixed-based percentage, but not more than 16% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

%

10. Enter average annual gross receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Base amount - Multiply line 10 by the percentage on line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Subtract line 11 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

13. Enter 50% (.50) of line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

14. Enter the smaller of line 12 or 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

PART III

TOTAL RESEARCH AND DEVELOPMENT TAX CREDIT

15. Enter the total of line 3 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

16. Enter 10% (.10) of line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

17. Research and Development Tax Credit carried forward from a prior tax year . . . . . . . . . . . . . . . . . . . . . . .

17.

18. Total Research and Development Tax Credit Available (Add line 16 and line 17) . . . . . . . . . . . . . . . . . . . .

18.

PART IV

CALCULATION OF THE ALLOWABLE CREDIT AMOUNT

19. Enter tax liability from page 1, line 9 of CBT-100 or BFC-1, or line 4 of Form CBT-100S . . . . . . . . . . . . . .

19.

20. Enter the required minimum tax liability as indicated in instruction (b) for Part IV . . . . . . . . . . . . . . . . . . . .

20.

21. Subtract line 20 from line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21.

22. Enter 50% (.50) of the tax liability reported on line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.

23. Enter the lesser of line 21 or line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23.

24. Tax credits taken on current year’s return:

a) Urban Transit Hub Tax Credit . . . . . . . . . . . . . . . . . . . . . .___________________________

b) Grow New Jersey Tax Credit . . . . . . . . . . . . . . . . . . . . . .___________________________

c) HMO Assistance Fund Tax Credit . . . . . . . . . . . . . . . . . . .___________________________

d) New Jobs Investment Tax Credit . . . . . . . . . . . . . . . . . . .___________________________

e) Urban Enterprise Zone Tax Credit . . . . . . . . . . . . . . . . . .___________________________

f) Redevelopment Authority Project Tax Credit . . . . . . . . . .___________________________

g) Recycling Equipment Tax Credit . . . . . . . . . . . . . . . . . . . .___________________________

h) Manufacturing Equipment and Employment

Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . .___________________________ . .TOTAL

24.

25. Subtract line 24 from line 23. If the result is less than zero, enter zero . . . . . . . . . . . . . . . . . . . . . . . . . . .

25.

26. Allowable credit for the current tax period - Enter the lesser of line 18 or line 25 here and on

Schedule A-3 of the CBT-100, the CBT-100S or the BFC-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26.

ATTACH COPY OF FEDERAL FORM 6765 FILED WITH THE IRS

1

1 2

2 3

3 4

4