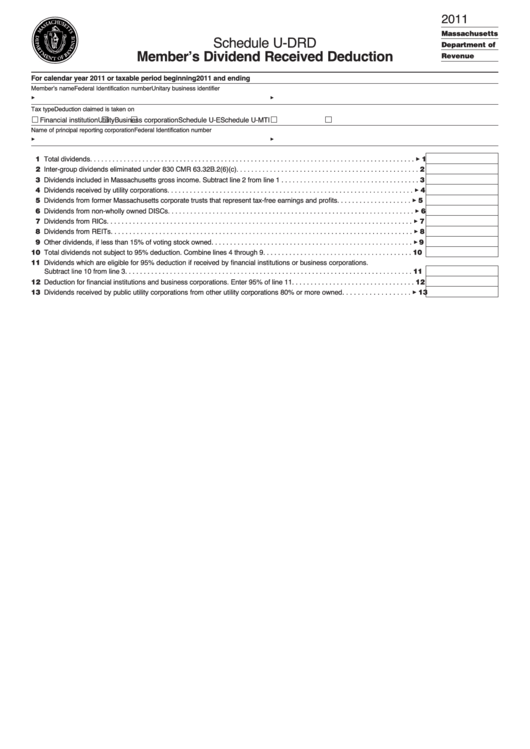

Schedule U-Drd - Member'S Dividend Received Deduction - 2011

ADVERTISEMENT

2011

Massachusetts

Schedule U-DRD

Department of

Member’s Dividend Received Deduction

Revenue

For calendar year 2011 or taxable period beginning

2011 and ending

Member’s name

Federal Identification number

Unitary business identifier

3

3

Tax type

Deduction claimed is taken on

Financial institution

Utility

Business corporation

Schedule U-E

Schedule U-MTI

Name of principal reporting corporation

Federal Identification number

3

3

1 Total dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

2 Inter-group dividends eliminated under 830 CMR 63.32B.2(6)(c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Dividends included in Massachusetts gross income. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Dividends received by utility corporations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Dividends from former Massachusetts corporate trusts that represent tax-free earnings and profits. . . . . . . . . . . . . . . . . . . . 3 5

6 Dividends from non-wholly owned DISCs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

7 Dividends from RICs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 7

8 Dividends from REITs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

9 Other dividends, if less than 15% of voting stock owned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 Total dividends not subject to 95% deduction. Combine lines 4 through 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Dividends which are eligible for 95% deduction if received by financial institutions or business corporations.

Subtract line 10 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Deduction for financial institutions and business corporations. Enter 95% of line 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Dividends received by public utility corporations from other utility corporations 80% or more owned . . . . . . . . . . . . . . . . . . 3 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1