Pine Tree Development Zone Tax Credit Worksheet - 2011

ADVERTISEMENT

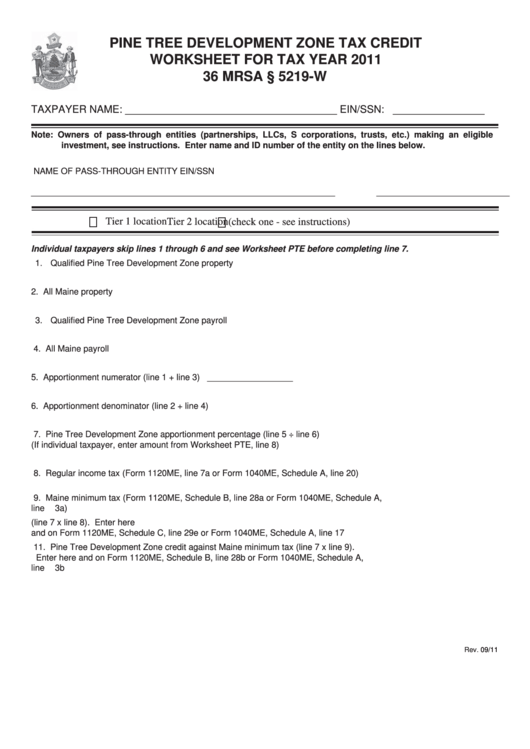

PINE TREE DEVELOPMENT ZONE TAX CREDIT

WORKSHEET FOR TAX YEAR 2011

36 MRSA § 5219-W

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Tier 1 location

Tier 2 location

(check one - see instructions)

Individual taxpayers skip lines 1 through 6 and see Worksheet PTE before completing line 7.

1. Qualifi ed Pine Tree Development Zone property ....................................................................1. __________________

2. All Maine property ...................................................................................................................2. __________________

3. Qualifi ed Pine Tree Development Zone payroll ......................................................................3. __________________

4. All Maine payroll ......................................................................................................................4. __________________

5. Apportionment numerator (line 1 + line 3) ..............................................................................5. __________________

6. Apportionment denominator (line 2 + line 4) ...........................................................................6. __________________

7. Pine Tree Development Zone apportionment percentage (line 5 ÷ line 6)

(If individual taxpayer, enter amount from Worksheet PTE, line 8) .........................................7. __________________

8. Regular income tax (Form 1120ME, line 7a or Form 1040ME, Schedule A, line 20) ..............8. __________________

9. Maine minimum tax (Form 1120ME, Schedule B, line 28a or Form 1040ME, Schedule A,

line 3a) ....................................................................................................................................9. __________________

10. Pine Tree Development Zone credit against regular tax (line 7 x line 8). Enter here

and on Form 1120ME, Schedule C, line 29e or Form 1040ME, Schedule A, line 17 ...........10. __________________

11. Pine Tree Development Zone credit against Maine minimum tax (line 7 x line 9).

Enter here and on Form 1120ME, Schedule B, line 28b or Form 1040ME, Schedule A,

line 3b ................................................................................................................................... 11. __________________

Rev.

09/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2