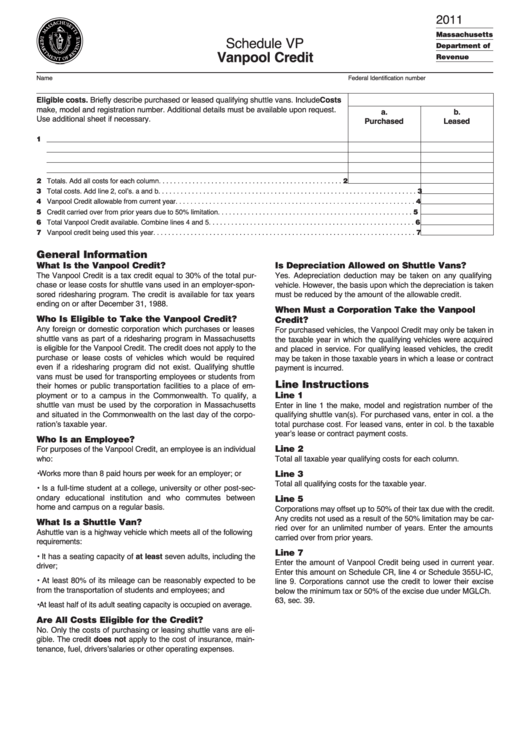

Schedule Vp - Vanpool Credit - 2011

ADVERTISEMENT

2011

Massachusetts

Schedule VP

Department of

Vanpool Credit

Revenue

Name

Federal Identification number

Eligible costs. Briefly describe purchased or leased qualifying shuttle vans. Include

Costs

make, model and registration number. Additional details must be available upon request.

a.

b.

Use additional sheet if necessary.

Purchased

Leased

1

2 Totals. Add all costs for each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total costs. Add line 2, col’s. a and b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Vanpool Credit allowable from current year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Credit carried over from prior years due to 50% limitation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Total Vanpool Credit available. Combine lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Vanpool credit being used this year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

General Information

What Is the Vanpool Credit?

Is Depreciation Allowed on Shuttle Vans?

The Vanpool Credit is a tax credit equal to 30% of the total pur-

Yes. A depreciation deduction may be taken on any qualifying

chase or lease costs for shuttle vans used in an employer-spon-

vehicle. However, the basis upon which the depreciation is taken

sored ridesharing program. The credit is available for tax years

must be reduced by the amount of the allowable credit.

ending on or after December 31, 1988.

When Must a Corporation Take the Vanpool

Who Is Eligible to Take the Vanpool Credit?

Credit?

Any foreign or domestic corporation which purchases or leases

For purchased vehicles, the Vanpool Credit may only be taken in

shuttle vans as part of a ridesharing program in Massachusetts

the taxable year in which the qualifying vehicles were acquired

is eligible for the Vanpool Credit. The credit does not apply to the

and placed in service. For qualifying leased vehicles, the credit

purchase or lease costs of vehicles which would be required

may be taken in those taxable years in which a lease or contract

even if a ridesharing program did not exist. Qualifying shuttle

payment is incurred.

vans must be used for transporting employees or students from

Line Instructions

their homes or public transportation facilities to a place of em-

Line 1

ployment or to a campus in the Commonwealth. To qualify, a

shuttle van must be used by the corporation in Massachusetts

Enter in line 1 the make, model and registration number of the

and situated in the Commonwealth on the last day of the corpo-

qualifying shuttle van(s). For purchased vans, enter in col. a the

ration’s taxable year.

total purchase cost. For leased vans, enter in col. b the taxable

year’s lease or contract payment costs.

Who Is an Employee?

Line 2

For purposes of the Vanpool Credit, an employee is an individual

who:

Total all taxable year qualifying costs for each column.

• Works more than 8 paid hours per week for an employer; or

Line 3

Total all qualifying costs for the taxable year.

• Is a full-time student at a college, university or other post-sec-

ondary educational institution and who commutes between

Line 5

home and campus on a regular basis.

Corporations may offset up to 50% of their tax due with the credit.

Any credits not used as a result of the 50% limitation may be car-

What Is a Shuttle Van?

ried over for an unlimited number of years. Enter the amounts

A shuttle van is a highway vehicle which meets all of the following

carried over from prior years.

requirements:

Line 7

• It has a seating capacity of at least seven adults, including the

Enter the amount of Vanpool Credit being used in current year.

driver;

Enter this amount on Schedule CR, line 4 or Schedule 355U-IC,

line 9. Corporations cannot use the credit to lower their excise

• At least 80% of its mileage can be reasonably expected to be

from the transportation of students and employees; and

below the minimum tax or 50% of the excise due under MGL Ch.

63, sec. 39.

• At least half of its adult seating capacity is occupied on average.

Are All Costs Eligible for the Credit?

No. Only the costs of purchasing or leasing shuttle vans are eli-

gible. The credit does not apply to the cost of insurance, main-

tenance, fuel, drivers’ salaries or other operating expenses.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1