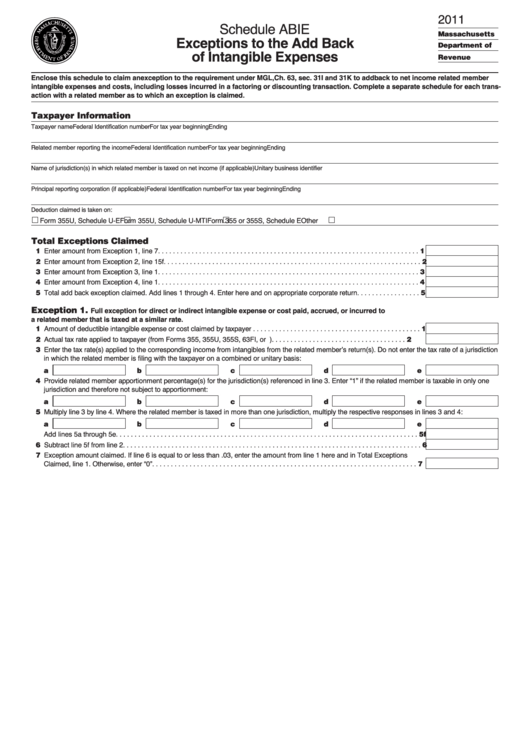

Schedule Abie - Exceptions To The Add Back Of Intangible Expenses - 2011

ADVERTISEMENT

2011

Schedule ABIE

Massachusetts

Exceptions to the Add Back

Department of

of Intangible Expenses

Revenue

Enclose this schedule to claim an exception to the requirement under MGL, Ch. 63, sec. 31I and 31K to add back to net income related member

intangible expenses and costs, including losses incurred in a factoring or discounting transaction. Complete a separate schedule for each trans-

action with a related member as to which an exception is claimed.

Taxpayer Information

Taxpayer name

Federal Identification number

For tax year beginning

Ending

Related member reporting the income

Federal Identification number

For tax year beginning

Ending

Name of jurisdiction(s) in which related member is taxed on net income (if applicable)

Unitary business identifier

Principal reporting corporation (if applicable)

Federal Identification number

For tax year beginning

Ending

Deduction claimed is taken on:

Form 355U, Schedule U-E

Form 355U, Schedule U-MTI

Form 355 or 355S, Schedule E

Other

Total Exceptions Claimed

01 Enter amount from Exception 1, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

02 Enter amount from Exception 2, line 15f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

03 Enter amount from Exception 3, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

04 Enter amount from Exception 4, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

05 Total add back exception claimed. Add lines 1 through 4. Enter here and on appropriate corporate return. . . . . . . . . . . . . . . . . 5

Exception 1.

Full exception for direct or indirect intangible expense or cost paid, accrued, or incurred to

a related member that is taxed at a similar rate.

01 Amount of deductible intangible expense or cost claimed by taxpayer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

02 Actual tax rate applied to taxpayer (from Forms 355, 355U, 355S, 63FI, or P.S.1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

03 Enter the tax rate(s) applied to the corresponding income from intangibles from the related member’s return(s). Do not enter the tax rate of a jurisdiction

in which the related member is filing with the taxpayer on a combined or unitary basis:

a

b

c

d

e

04 Provide related member apportionment percentage(s) for the jurisdiction(s) referenced in line 3. Enter “1” if the related member is taxable in only one

jurisdiction and therefore not subject to apportionment:

a

b

c

d

e

05 Multiply line 3 by line 4. Where the related member is taxed in more than one jurisdiction, multiply the respective responses in lines 3 and 4:

a

b

c

d

e

Add lines 5a through 5e. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5f

06 Subtract line 5f from line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

07 Exception amount claimed. If line 6 is equal to or less than .03, enter the amount from line 1 here and in Total Exceptions

Claimed, line 1. Otherwise, enter “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4