Maine Fishery Infrastructure Investment Tax Credit Worksheet - 2011

ADVERTISEMENT

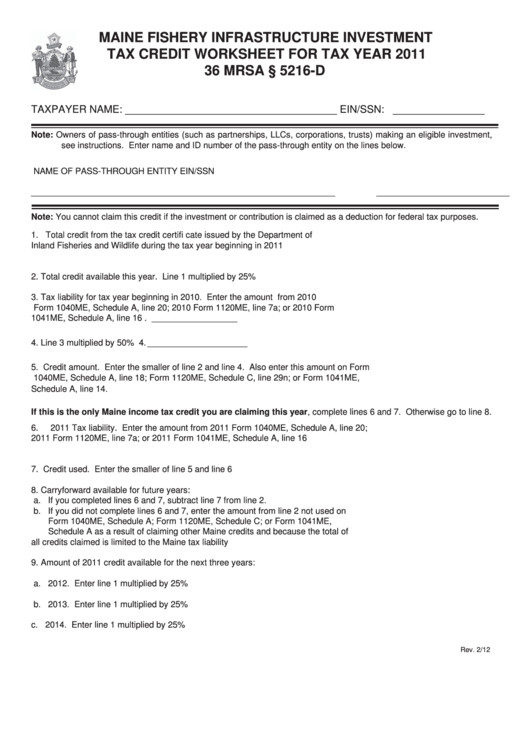

MAINE FISHERY INFRASTRUCTURE INVESTMENT

TAX CREDIT WORKSHEET FOR TAX YEAR 2011

36 MRSA § 5216-D

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (such as partnerships, LLCs, corporations, trusts) making an eligible investment,

see instructions. Enter name and ID number of the pass-through entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

Note: You cannot claim this credit if the investment or contribution is claimed as a deduction for federal tax purposes.

1.

Total credit from the tax credit certifi cate issued by the Department of

Inland Fisheries and Wildlife during the tax year beginning in 2011 ............................... 1. _____________________

2.

Total credit available this year. Line 1 multiplied by 25% ................................................. 2. _____________________

3.

Tax liability for tax year beginning in 2010. Enter the amount from 2010

Form 1040ME, Schedule A, line 20; 2010 Form 1120ME, line 7a; or 2010 Form

1041ME, Schedule A, line 16 . .............................................................. ........................... 3. _____________________

4.

Line 3 multiplied by 50% ...................................................................................................4. _____________________

5.

Credit amount. Enter the smaller of line 2 and line 4. Also enter this amount on Form

1040ME, Schedule A, line 18; Form 1120ME, Schedule C, line 29n; or Form 1041ME,

Schedule A, line 14. ....................................................................................................... 5. _____________________

If this is the only Maine income tax credit you are claiming this year, complete lines 6 and 7. Otherwise go to line 8.

6.

2011 Tax liability. Enter the amount from 2011 Form 1040ME, Schedule A, line 20;

2011 Form 1120ME, line 7a; or 2011 Form 1041ME, Schedule A, line 16 ....................... 6. ____________________

7.

Credit used. Enter the smaller of line 5 and line 6 ........................................................... 7. _____________________

8.

Carryforward available for future years:

a. If you completed lines 6 and 7, subtract line 7 from line 2.

b. If you did not complete lines 6 and 7, enter the amount from line 2 not used on

Form 1040ME, Schedule A; Form 1120ME, Schedule C; or Form 1041ME,

Schedule A as a result of claiming other Maine credits and because the total of

all credits claimed is limited to the Maine tax liability .................................................. 8. _____________________

9.

Amount of 2011 credit available for the next three years:

a. 2012. Enter line 1 multiplied by 25% ....................................................................... 9a. _____________________

b. 2013. Enter line 1 multiplied by 25% ....................................................................... 9b. _____________________

c. 2014. Enter line 1 multiplied by 25% ....................................................................... 9c. _____________________

Rev. 2/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2