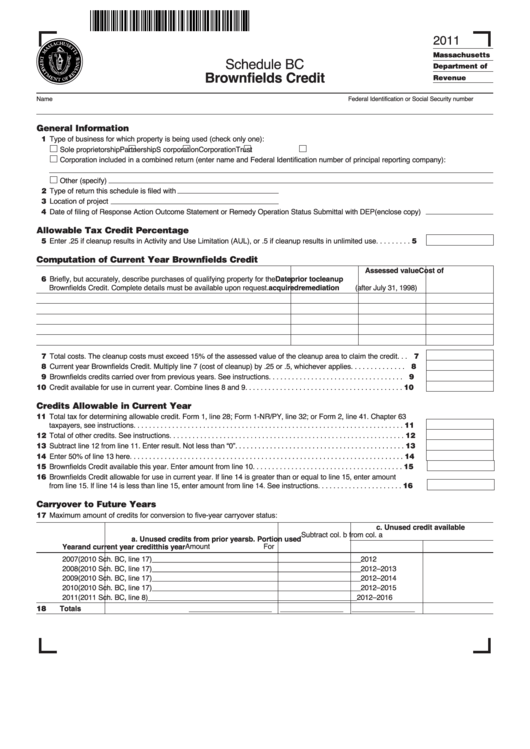

Schedule Bc - Brownfields Credit - 2011

ADVERTISEMENT

2011

Massachusetts

Schedule BC

Department of

Brownfields Credit

Revenue

Name

Federal Identification or Social Security number

General Information

11 Type of business for which property is being used (check only one):

Sole proprietorship

Partnership

S corporation

Corporation

Trust

Corporation included in a combined return (enter name and Federal Identification number of principal reporting company):

Other (specify)

12 Type of return this schedule is filed with

13 Location of project

14 Date of filing of Response Action Outcome Statement or Remedy Operation Status Submittal with DEP (enclose copy)

Allowable Tax Credit Percentage

15 Enter .25 if cleanup results in Activity and Use Limitation (AUL), or .5 if cleanup results in unlimited use . . . . . . . . . 5

Computation of Current Year Brownfields Credit

Assessed value

Cost of

16 Briefly, but accurately, describe purchases of qualifying property for the

Date

prior to

cleanup

Brownfields Credit. Complete details must be available upon request.

acquired

remediation

(after July 31, 1998)

17 Total costs. The cleanup costs must exceed 15% of the assessed value of the cleanup area to claim the credit . . . 17

18 Current year Brownfields Credit. Multiply line 7 (cost of cleanup) by .25 or .5, whichever applies . . . . . . . . . . . . . . 18

19 Brownfields credits carried over from previous years. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

10 Credit available for use in current year. Combine lines 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Credits Allowable in Current Year

11 Total tax for determining allowable credit. Form 1, line 28; Form 1-NR/PY, line 32; or Form 2, line 41. Chapter 63

taxpayers, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Total of other credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Subtract line 12 from line 11. Enter result. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Enter 50% of line 13 here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Brownfields Credit available this year. Enter amount from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Brownfields Credit allowable for use in current year. If line 14 is greater than or equal to line 15, enter amount

from line 15. If line 14 is less than line 15, enter amount from line 14. See instructions . . . . . . . . . . . . . . . . . . . . . . 16

Carryover to Future Years

17 Maximum amount of credits for conversion to five-year carryover status:

c. Unused credit available

Subtract col. b from col. a

a. Unused credits from prior years

b. Portion used

Amount

For

Year

and current year credit

this year

2007

(2010 Sch. BC, line 17) _____________________

________________

________________

2012

2008

(2010 Sch. BC, line 17) _____________________

________________

________________

2012–2013

2009

(2010 Sch. BC, line 17) _____________________

________________

________________

2012–2014

2010

(2010 Sch. BC, line 17) _____________________

________________

________________

2012–2015

2011

(2011 Sch. BC, line 8)

_____________________

________________

________________

2012–2016

18

Totals

_____________________

________________

________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2