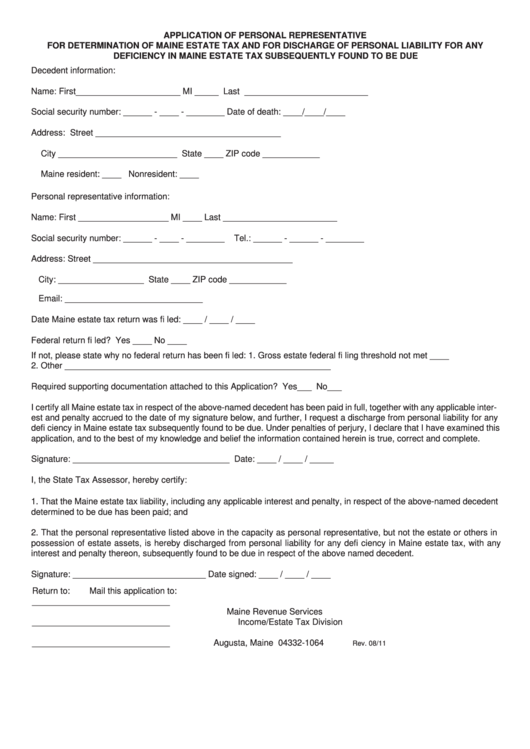

Application Of Personal Representative For Determination Of Maine Estate Tax And For Discharge Of Personal Liability For Any Deficiency In Maine Estate Tax Subsequently Found To Be Due

ADVERTISEMENT

APPLICATION OF PERSONAL REPRESENTATIVE

FOR DETERMINATION OF MAINE ESTATE TAX AND FOR DISCHARGE OF PERSONAL LIABILITY FOR ANY

DEFICIENCY IN MAINE ESTATE TAX SUBSEQUENTLY FOUND TO BE DUE

Decedent information:

Name: First______________________ MI _____ Last __________________________

Social security number: ______ - ____ - ________ Date of death: ____/____/____

Address: Street _______________________________________

City _________________________ State ____ ZIP code ____________

Maine resident: ____

Nonresident: ____

Personal representative information:

Name: First ___________________ MI ____ Last ________________________

Social security number: ______ - ____ - ________

Tel.: ______ - ______ - ________

Address: Street __________________________________________

City: __________________ State ____ ZIP code ____________

Email: _____________________________

Date Maine estate tax return was fi led: ____ / ____ / ____

Federal return fi led? Yes ____ No ____

If not, please state why no federal return has been fi led: 1. Gross estate federal fi ling threshold not met ____

2. Other ________________________________________________________

Required supporting documentation attached to this Application? Yes___ No___

I certify all Maine estate tax in respect of the above-named decedent has been paid in full, together with any applicable inter-

est and penalty accrued to the date of my signature below, and further, I request a discharge from personal liability for any

defi ciency in Maine estate tax subsequently found to be due. Under penalties of perjury, I declare that I have examined this

application, and to the best of my knowledge and belief the information contained herein is true, correct and complete.

Signature: _________________________________ Date: ____ / ____ / _____

I, the State Tax Assessor, hereby certify:

1. That the Maine estate tax liability, including any applicable interest and penalty, in respect of the above-named decedent

determined to be due has been paid; and

2. That the personal representative listed above in the capacity as personal representative, but not the estate or others in

possession of estate assets, is hereby discharged from personal liability for any defi ciency in Maine estate tax, with any

interest and penalty thereon, subsequently found to be due in respect of the above named decedent.

Signature: ____________________________ Date signed: ____ / ____ / ____

Return to:

Mail this application to:

_____________________________

Maine Revenue Services

_____________________________

Income/Estate Tax Division

P.O. Box 1064

_____________________________

Augusta, Maine 04332-1064

Rev. 08/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2