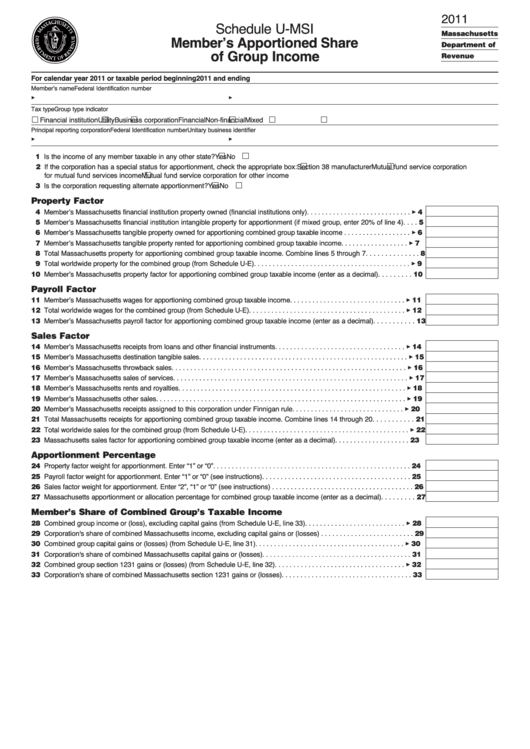

Schedule U-Msi - Member'S Apportioned Share Of Group Income - 2011

ADVERTISEMENT

2011

Schedule U-MSI

Massachusetts

Member’s Apportioned Share

Department of

of Group Income

Revenue

For calendar year 2011 or taxable period beginning

2011 and ending

Member’s name

Federal Identification number

3

3

Tax type

Group type indicator

Financial institution

Utility

Business corporation

Financial

Non-financial

Mixed

Principal reporting corporation

Federal Identification number

Unitary business identifier

3

3

1 Is the income of any member taxable in any other state?

Yes

No

12 If the corporation has a special status for apportionment, check the appropriate box:

Section 38 manufacturer

Mutual fund service corporation

for mutual fund services income

Mutual fund service corporation for other income

3 Is the corporation requesting alternate apportionment?

Yes

No

Property Factor

4 Member’s Massachusetts financial institution property owned (financial institutions only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

5 Member’s Massachusetts financial institution intangible property for apportionment (if mixed group, enter 20% of line 4) . . . . 5

6 Member’s Massachusetts tangible property owned for apportioning combined group taxable income . . . . . . . . . . . . . . . . . . 3 6

7 Member’s Massachusetts tangible property rented for apportioning combined group taxable income . . . . . . . . . . . . . . . . . . 3 7

8 Total Massachusetts property for apportioning combined group taxable income. Combine lines 5 through 7 . . . . . . . . . . . . . . 8

9 Total worldwide property for the combined group (from Schedule U-E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 Member’s Massachusetts property factor for apportioning combined group taxable income (enter as a decimal) . . . . . . . . . 10

Payroll Factor

11 Member’s Massachusetts wages for apportioning combined group taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Total worldwide wages for the combined group (from Schedule U-E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Member’s Massachusetts payroll factor for apportioning combined group taxable income (enter as a decimal). . . . . . . . . . . 13

Sales Factor

14 Member’s Massachusetts receipts from loans and other financial instruments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Member’s Massachusetts destination tangible sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Member’s Massachusetts throwback sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Member’s Massachusetts sales of services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Member’s Massachusetts rents and royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

19 Member’s Massachusetts other sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

20 Member’s Massachusetts receipts assigned to this corporation under Finnigan rule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Total Massachusetts receipts for apportioning combined group taxable income. Combine lines 14 through 20 . . . . . . . . . . . 21

22 Total worldwide sales for the combined group (from Schedule U-E). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Massachusetts sales factor for apportioning combined group taxable income (enter as a decimal) . . . . . . . . . . . . . . . . . . . . 23

Apportionment Percentage

24 Property factor weight for apportionment. Enter “1” or “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Payroll factor weight for apportionment. Enter “1” or “0” (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Sales factor weight for apportionment. Enter “2”, “1” or “0” (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Massachusetts apportionment or allocation percentage for combined group taxable income (enter as a decimal). . . . . . . . . 27

Member’s Share of Combined Group’s Taxable Income

28 Combined group income or (loss), excluding capital gains (from Schedule U-E, line 33) . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 28

29 Corporation's share of combined Massachusetts income, excluding capital gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Combined group capital gains or (losses) (from Schedule U-E, line 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 30

31 Corporation's share of combined Massachusetts capital gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Combined group section 1231 gains or (losses) (from Schedule U-E, line 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 32

33 Corporation's share of combined Massachusetts section 1231 gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1