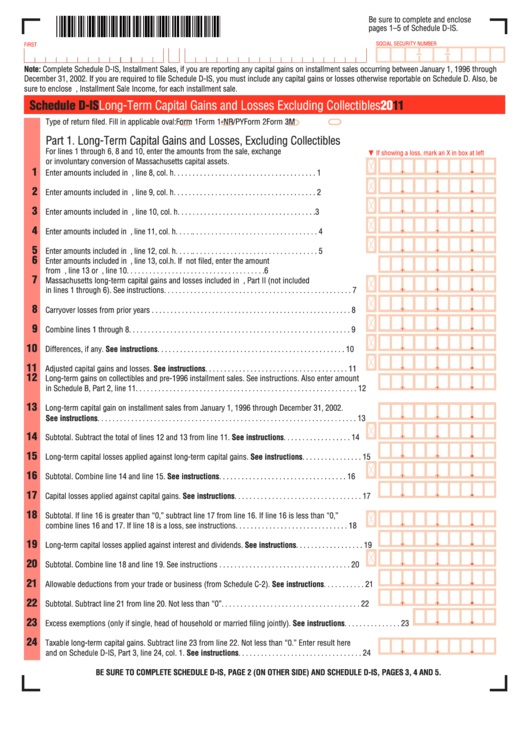

Schedule D-Is - Long-Term Capital Gains And Losses Excluding Collectibles - 2011

ADVERTISEMENT

Be sure to complete and enclose

1

1

pages 1–5 of Schedule D-IS.

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

Note: Complete Schedule D-IS, Installment Sales, if you are reporting any capital gains on installment sales occurring between January 1, 1996 through

December 31, 2002. If you are required to file Schedule D-IS, you must include any capital gains or losses otherwise reportable on Schedule D. Also, be

sure to enclose U.S. Form 6252, Installment Sale Income, for each installment sale.

Schedule D-IS

Long-Term Capital Gains and Losses Excluding Collectibles

2011

Type of return filed. Fill in applicable oval:

Form 1

Form 1-NR/PY

Form 2

Form 3M

Part 1. Long-Term Capital Gains and Losses, Excluding Collectibles

For lines 1 through 6, 8 and 10, enter the amounts from the sale, exchange

▼

If showing a loss, mark an X in box at left

or involuntary conversion of Massachusetts capital assets.

1

Enter amounts included in U.S. Sch. D, line 8, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2

Enter amounts included in U.S. Sch. D, line 9, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3

Enter amounts included in U.S. Sch. D, line 10, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Enter amounts included in U.S. Sch. D, line 11, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Enter amounts included in U.S. Sch. D, line 12, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

Enter amounts included in U.S. Sch. D, line 13, col. h. If U.S. Schedule D not filed, enter the amount

from U.S. Form 1040, line 13 or U.S. Form 1040A, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7

Massachusetts long-term capital gains and losses included in U.S. Form 4797, Part II (not included

in lines 1 through 6). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Carryover losses from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9

Combine lines 1 through 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10

Differences, if any. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Adjusted capital gains and losses. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Long-term gains on collectibles and pre-1996 installment sales. See instructions. Also enter amount

in Schedule B, Part 2, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

Long-term capital gain on installment sales from January 1, 1996 through December 31, 2002.

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14

Subtotal. Subtract the total of lines 12 and 13 from line 11. See instructions . . . . . . . . . . . . . . . . . . 14

15

Long-term capital losses applied against long-term capital gains. See instructions . . . . . . . . . . . . . . . . 15

16

Subtotal. Combine line 14 and line 15. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17

Capital losses applied against capital gains. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18

Subtotal. If line 16 is greater than “0,” subtract line 17 from line 16. If line 16 is less than “0,”

combine lines 16 and 17. If line 18 is a loss, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19

Long-term capital losses applied against interest and dividends. See instructions . . . . . . . . . . . . . . . . . . 19

20

Subtotal. Combine line 18 and line 19. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21

Allowable deductions from your trade or business (from Schedule C-2). See instructions . . . . . . . . . . . 21

22

Subtotal. Subtract line 21 from line 20. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23

Excess exemptions (only if single, head of household or married filing jointly). See instructions . . . . . . . . . . . . . . . 23

24

Taxable long-term capital gains. Subtract line 23 from line 22. Not less than “0.” Enter result here

and on Schedule D-IS, Part 3, line 24, col. 1. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

BE SURE TO COMPLETE SCHEDULE D-IS, PAGE 2 (ON OTHER SIDE) AND SCHEDULE D-IS, PAGES 3, 4 AND 5.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5