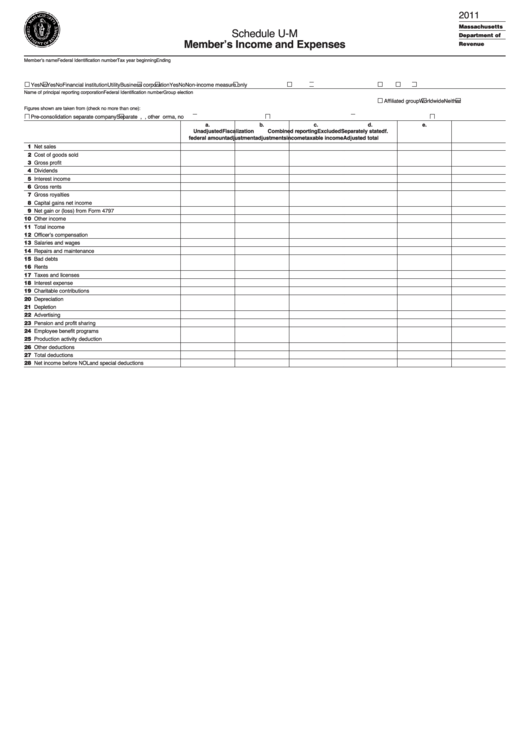

Schedule U-M - Member'S Income And Expenses - 2011

ADVERTISEMENT

2011

Massachusetts

Schedule U-M

Department of

Member’s Income and Expenses

Revenue

Member’s name

Federal Identification number

Tax year beginning

Ending

Non-U.S. corporation

Treaty-based income exclusion

Tax type

Taxable member

Yes

No

Yes

No

Financial institution

Utility

Business corporation

Yes

No

Non-income measure only

Name of principal reporting corporation

Federal Identification number

Group election

Affiliated group

Worldwide

Neither

Figures shown are taken from (check no more than one):

Pre-consolidation separate company

Separate U.S. 1120 as filed

Pro forma, U.S. 1120S filed

Pro forma, other U.S. return filed

Pro forma, no U.S. return filed

Eliminations/adjustments

a.

b.

c.

d.

e.

Unadjusted

Fiscalization

Combined reporting

Excluded

Separately stated

f.

federal amount

adjustment

adjustments

income

taxable income

Adjusted total

01 Net sales

02 Cost of goods sold

03 Gross profit

04 Dividends

05 Interest income

06 Gross rents

07 Gross royalties

08 Capital gains net income

09 Net gain or (loss) from Form 4797

10 Other income

11 Total income

12 Officer’s compensation

13 Salaries and wages

14 Repairs and maintenance

15 Bad debts

16 Rents

17 Taxes and licenses

18 Interest expense

19 Charitable contributions

20 Depreciation

21 Depletion

22 Advertising

23 Pension and profit sharing

24 Employee benefit programs

25 Production activity deduction

26 Other deductions

27 Total deductions

28 Net income before NOL and special deductions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1