Instructions For Louisiana Nonresident Professional Athlete Individual Income Tax Return - 2011

ADVERTISEMENT

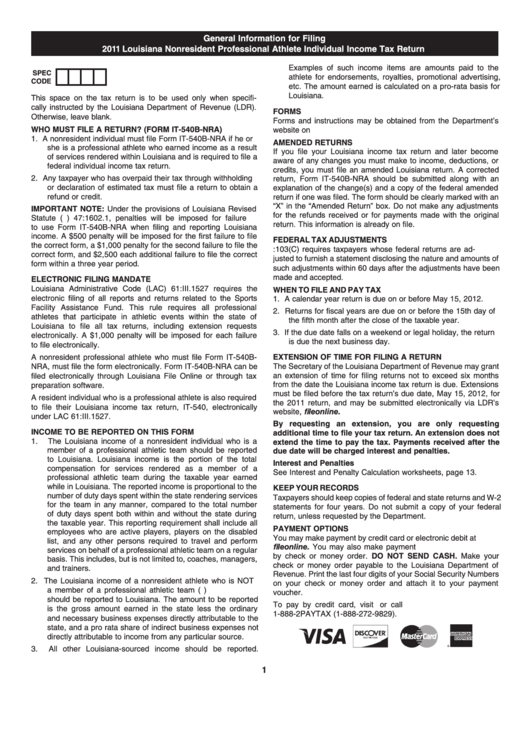

General Information for Filing

2011 Louisiana Nonresident Professional Athlete Individual Income Tax Return

Examples of such income items are amounts paid to the

SPEC

athlete for endorsements, royalties, promotional advertising,

CODE

etc. The amount earned is calculated on a pro-rata basis for

Louisiana.

This space on the tax return is to be used only when specifi-

cally instructed by the Louisiana Department of Revenue (LDR).

FORMS

Otherwise, leave blank.

Forms and instructions may be obtained from the Department’s

WHO MUST FILE A RETURN? (FORM IT-540B-NRA)

website on

1.

A nonresident individual must file Form IT-540B-NRA if he or

AMENDED RETURNS

she is a professional athlete who earned income as a result

If you file your Louisiana income tax return and later become

of services rendered within Louisiana and is required to file a

aware of any changes you must make to income, deductions, or

federal individual income tax return.

credits, you must file an amended Louisiana return. A corrected

2.

Any taxpayer who has overpaid their tax through withholding

return, Form IT-540B-NRA should be submitted along with an

or declaration of estimated tax must file a return to obtain a

explanation of the change(s) and a copy of the federal amended

refund or credit.

return if one was filed. The form should be clearly marked with an

“X” in the “Amended Return” box. Do not make any adjustments

IMPORTANT NOTE: Under the provisions of Louisiana Revised

for the refunds received or for payments made with the original

Statute (R.S.) 47:1602.1, penalties will be imposed for failure

return. This information is already on file.

to use Form IT-540B-NRA when filing and reporting Louisiana

income. A $500 penalty will be imposed for the first failure to file

FEDERAL TAX ADJUSTMENTS

the correct form, a $1,000 penalty for the second failure to file the

R.S. 47:103(C) requires taxpayers whose federal returns are ad-

correct form, and $2,500 each additional failure to file the correct

justed to furnish a statement disclosing the nature and amounts of

form within a three year period.

such adjustments within 60 days after the adjustments have been

made and accepted.

ELECTRONIC FILING MANDATE

Louisiana Administrative Code (LAC) 61:III.1527 requires the

WHEN TO FILE AND PAY TAX

electronic filing of all reports and returns related to the Sports

1.

A calendar year return is due on or before May 15, 2012.

Facility Assistance Fund. This rule requires all professional

2.

Returns for fiscal years are due on or before the 15th day of

athletes that participate in athletic events within the state of

the fifth month after the close of the taxable year.

Louisiana to file all tax returns, including extension requests

3.

If the due date falls on a weekend or legal holiday, the return

electronically. A $1,000 penalty will be imposed for each failure

is due the next business day.

to file electronically.

A nonresident professional athlete who must file Form IT-540B-

EXTENSION OF TIME FOR FILING A RETURN

The Secretary of the Louisiana Department of Revenue may grant

NRA, must file the form electronically. Form IT-540B-NRA can be

an extension of time for filing returns not to exceed six months

filed electronically through Louisiana File Online or through tax

from the date the Louisiana income tax return is due. Extensions

preparation software.

must be filed before the tax return’s due date, May 15, 2012, for

A resident individual who is a professional athlete is also required

the 2011 return, and may be submitted electronically via LDR’s

to file their Louisiana income tax return, IT-540, electronically

website,

under LAC 61:III.1527.

By requesting an extension, you are only requesting

INCOME TO BE REPORTED ON THIS FORM

additional time to file your tax return. An extension does not

1.

The Louisiana income of a nonresident individual who is a

extend the time to pay the tax. Payments received after the

member of a professional athletic team should be reported

due date will be charged interest and penalties.

to Louisiana. Louisiana income is the portion of the total

Interest and Penalties

compensation for services rendered as a member of a

See Interest and Penalty Calculation worksheets, page 13.

professional athletic team during the taxable year earned

while in Louisiana. The reported income is proportional to the

KEEP YOUR RECORDS

number of duty days spent within the state rendering services

Taxpayers should keep copies of federal and state returns and W-2

for the team in any manner, compared to the total number

statements for four years. Do not submit a copy of your federal

of duty days spent both within and without the state during

return, unless requested by the Department.

the taxable year. This reporting requirement shall include all

PAYMENT OPTIONS

employees who are active players, players on the disabled

You may make payment by credit card or electronic debit at www.

list, and any other persons required to travel and perform

revenue.louisiana.gov/fileonline. You may also make payment

services on behalf of a professional athletic team on a regular

by check or money order. DO NOT SEND CASH. Make your

basis. This includes, but is not limited to, coaches, managers,

check or money order payable to the Louisiana Department of

and trainers.

Revenue. Print the last four digits of your Social Security Numbers

2.

The Louisiana income of a nonresident athlete who is NOT

on your check or money order and attach it to your payment

a member of a professional athletic team (e.g. PGA golfer)

voucher.

should be reported to Louisiana. The amount to be reported

To pay by credit card, visit or call

is the gross amount earned in the state less the ordinary

1-888-2PAYTAX (1-888-272-9829).

and necessary business expenses directly attributable to the

state, and a pro rata share of indirect business expenses not

directly attributable to income from any particular source.

3.

All other Louisiana-sourced income should be reported.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13