Schedule Tcs (Form 41a720tcs) - Tax Credit Summary Schedule

ADVERTISEMENT

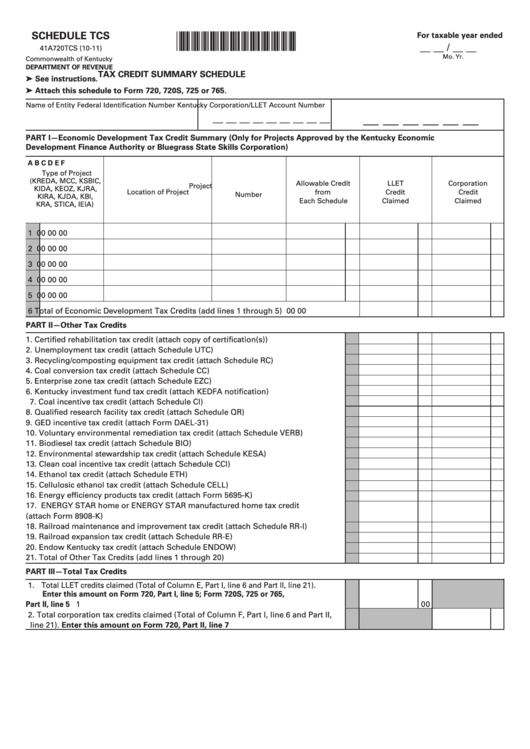

SCHEDULE TCS

For taxable year ended

*1100020218*

__ __ / __ __

41A720TCS (10-11)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

TAX CREDIT SUMMARY SCHEDULE

➤ See instructions.

➤ Attach this schedule to Form 720, 720S, 725 or 765.

Name of Entity

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

PART I—Economic Development Tax Credit Summary (Only for Projects Approved by the Kentucky Economic

Development Finance Authority or Bluegrass State Skills Corporation)

A

B

C

D

E

F

Type of Project

(KREDA, MCC, KSBIC,

Allowable Credit

LLET

Corporation

Project

KIDA, KEOZ, KJRA,

Location of Project

from

Credit

Credit

Number

KIRA, KJDA, KBI,

Each Schedule

Claimed

Claimed

KRA, STICA, IEIA)

1

00

00

00

2

00

00

00

3

00

00

00

4

00

00

00

5

00

00

00

6 Total of Economic Development Tax Credits (add lines 1 through 5)

00

00

PART II—Other Tax Credits

1. Certified rehabilitation tax credit (attach copy of certification(s)) ...............................

1

00

00

2. Unemployment tax credit (attach Schedule UTC).........................................................

2

00

00

3. Recycling/composting equipment tax credit (attach Schedule RC) .............................

3

00

00

4. Coal conversion tax credit (attach Schedule CC) ..........................................................

4

00

00

5. Enterprise zone tax credit (attach Schedule EZC) .........................................................

5

00

00

6. Kentucky investment fund tax credit (attach KEDFA notification) ...............................

6

00

00

7. Coal incentive tax credit (attach Schedule CI) ...............................................................

7

00

00

8. Qualified research facility tax credit (attach Schedule QR) ..........................................

8

00

00

9. GED incentive tax credit (attach Form DAEL-31) ...........................................................

9

00

00

10. Voluntary environmental remediation tax credit (attach Schedule VERB) .................. 10

00

00

11. Biodiesel tax credit (attach Schedule BIO) ..................................................................... 11

00

00

12. Environmental stewardship tax credit (attach Schedule KESA) .................................. 12

00

00

13. Clean coal incentive tax credit (attach Schedule CCI) ................................................... 13

00

00

14. Ethanol tax credit (attach Schedule ETH)....................................................................... 14

00

00

15. Cellulosic ethanol tax credit (attach Schedule CELL) .................................................... 15

00

00

16. Energy efficiency products tax credit (attach Form 5695-K) ........................................ 16

00

00

17. ENERGY STAR home or ENERGY STAR manufactured home tax credit

(attach Form 8908-K) ....................................................................................................... 17

00

00

18. Railroad maintenance and improvement tax credit (attach Schedule RR-I) ............... 18

00

00

19. Railroad expansion tax credit (attach Schedule RR-E) .................................................. 19

00

00

20. Endow Kentucky tax credit (attach Schedule ENDOW) ............................................... 20

00

00

21. Total of Other Tax Credits (add lines 1 through 20) ...................................................... 21

00

00

PART III—Total Tax Credits

1. Total LLET credits claimed (Total of Column E, Part I, line 6 and Part II, line 21).

Enter this amount on Form 720, Part I, line 5; Form 720S, 725 or 765,

Part II, line 5 ............................................................................................................................

1

00

2. Total corporation tax credits claimed (Total of Column F , Part I, line 6 and Part II,

line 21). Enter this amount on Form 720, Part II, line 7 ................................................

2

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2