Form 41a720sl - Application For Six-Month Extension Of Time To File Kentucky Corporation Or Limited Liability Pass-Through Entity Return

ADVERTISEMENT

FORM 41A720SL INSTRUCTIONS

In accordance with the provisions of KRS 131.081(11), KRS 131.170,

Consolidated Returns—An extension of time for filing a consolidated

KRS 141.170, and Regulation 103 KAR 15:050, an extension of time

Kentucky corporation income tax and LLET return also constitutes

to file a Kentucky corporation income tax and LLET return or a

an extension of time for filing for each member of the affiliated

limited liability pass-through entity income and LLET return may

group.

be obtained by either:

Form 851-K listing all includible corporations must be submitted

1.

requesting an extension pursuant to KRS 141.170 before the date

with the Form 41A720SL.

prescribed by KRS 141.160 for filing the return, i.e., the 15th day

of the fourth month following the close of the taxable year. Use

Payment of Tax—An extension of time to file a return does not

Kentucky Form 41A720SL, which is available at

extend the date prescribed for payment of tax. Therefore, a check

ky.gov; or

made payable to the Kentucky State Treasurer for the amount of

any unpaid tax should be submitted to the Department of Revenue

2.

submitting with your return a copy of federal Form 7004,

along with Form 41A720SL on or before the 15th day of the fourth

Application for Automatic Extension of Time To File Certain

month following the close of the taxable year.

Business Income Tax, Information, and Other Returns.

Electronic Funds Transfer (EFT)—LLET estimated tax payments

Federal Extension—A corporation or limited liability pass-through

are not permitted by EFT. The Department of Revenue is accepting

entity granted an extension of time for filing a federal income tax

electronically filed Corporation Income Tax/Limited Liability Entity

return will be granted the same extension of time for filing a Kentucky

Tax estimated tax voucher payments only for corporation income

income and LLET return for the same taxable year provided a copy of

tax. Before filing by EFT, the corporation must have a valid six-digit

the federal Form 7004 is attached to the Kentucky income and LLET

Kentucky Corporation/LLET account number and have registered

return when it is filed. A copy of the federal Form 7004 shall not be

with the Department of Revenue to file EFT. Using an incorrect

mailed to the Department of Revenue before filing the return.

account number, such as an account number for withholding tax

If submitting payment with extension, use Kentucky Form

or sales and use tax, will result in the payment being credited to

41A720SL.

another corporation's account. For more information, contact the

Department of Revenue at 1-800-839-4137 or (502) 564-6020. The

Kentucky Extension—An extension of time to file a corporation or

EFT registration form is available at ky.gov. See

limited liability pass-through entity income and LLET return may be

E-File & E-Payment Options (click on KY E-Tax). The direct link is

obtained by either making a specific request to the Department of

ky.gov/etax.htm.

Revenue or attaching a copy of the federal extension to the return

when filed. A copy of the federal extension (Form 7004) submitted

EFT is not available for a corporation's or limited liability pass-through

after the return is filed does not constitute a valid extension, and

entity's LLET estimated tax payments, return payment or extension

late filing penalties will be assessed. If a corporation or limited

payment.

liability pass-through entity is making a payment with its extension,

Penalty—A penalty of 2 percent of the tax due for each 30 days or

Kentucky Form 41A720SL must be used.

fraction thereof may apply to any tax not paid by the 15th day of the

fourth month following the close of the taxable year.

A copy of either federal Form 7004 or Kentucky Form 41A720SL

must be attached to the return when filed, and a copy should

Interest—Interest at the tax interest rate plus 2% applies to any tax

be retained for the corporation’s or limited liability pass-through

paid after the 15th day of the fourth month following the close of

entity's records.

the taxable year.

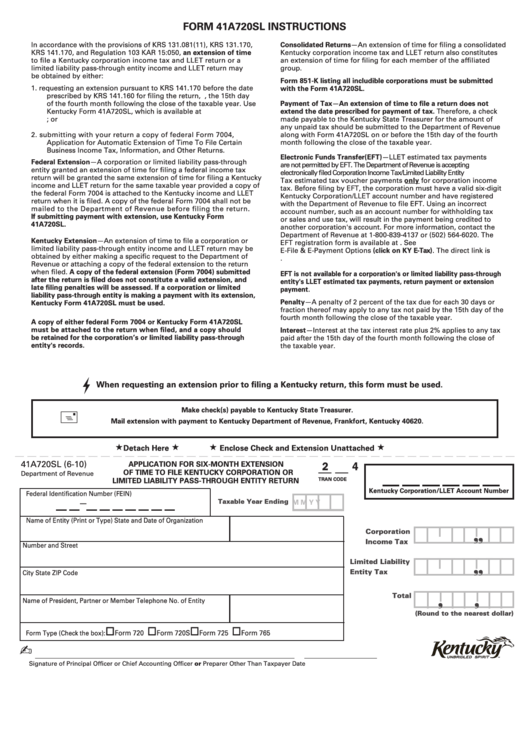

When requesting an extension prior to filing a Kentucky return, this form must be used.

Make check(s) payable to Kentucky State Treasurer.

Mail extension with payment to Kentucky Department of Revenue, Frankfort, Kentucky 40620.

Detach Here

Enclose Check and Extension Unattached

41A720SL (6-10)

__ __

2 4

APPLICATION FOR SIX-MONTH EXTENSION

OF TIME TO FILE KENTUCKY CORPORATION OR

Department of Revenue

LIMITED LIABILITY PASS-THROUGH ENTITY RETURN

TRAN CODE

Kentucky Corporation/LLET Account Number

Federal Identification Number (FEIN)

Taxable Year Ending

—

M M Y

Y

Name of Entity (Print or Type)

State and Date of Organization

Corporation

❜

❜

Income Tax

Number and Street

Limited Liability

Entity Tax

City

State

ZIP Code

❜

❜

Total

Name of President, Partner or Member

Telephone No. of Entity

❜

❜

(Round to the nearest dollar)

Form 720

Form 720S

Form 725

Form 765

Form Type (Check the box):

✍

Signature of Principal Officer or Chief Accounting Officer or Preparer Other Than Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1