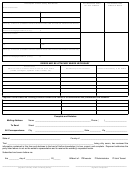

L-9 NR

L-9 NR

NON RESIDENT DECEDENTS ONLY

2/07

Decedent’s Name: ___________________________________________________________________________________________________________

(Last)

(First)

(MI)

Decedent’s SS No. _____________________________ Date of Death (mm/dd/yy) ____________________ State of Domicile: ___________________

THE FOLLOWING QUESTIONS MUST BE ANSWERED:

1. The decedent died

Testate

Intestate

at _________________________________________________________________________________________________________

(Address)

_________________________________ _________________

on __________________________________________________

(City)

(State)

(Date)

A. The decedent’s actual place of residence was: ____________________________________________________________________

(Address)

Where he/she lived from _________________________________ to _________________________________

B. The decedent’s voting address was ____________________________________________________________________________

and he/she last voted in _________________________________

(Year)

C. The decedent’s last Income Tax Return listed his/her address as: _____________________________________________________

D. The decedent formerly lived in New Jersey at: ____________________________________________________________________

but moved to ______________________________________________________________ on _____________________________

(Address)

(Date)

2. Does the value of the decedent’s entire estate, wherever located, exceed $675,000?

Yes

No

Approximate value: $____________________________

3. Did the decedent own any assets, located anywhere, that were jointly owned with someone other than a

Class “A” beneficiary?

Yes

No

4. Did the decedent transfer any assets, located anywhere, to someone other than a Class “A” beneficiary during the 3 year period prior

to death?

Yes

No

If yes, explain ___________________________________________________________________

___________________________________________________________________________________________________________

5. Did the decedent transfer any asset at any time during his/her lifetime, in which he/she retained the use of the asset for the rest of

his/her lifetime?

Yes

No

If yes, explain ____________________________________________________________

___________________________________________________________________________________________________________

6. Did the decedent own any annuity contract(s) payable on death to someone other than a Class “A” beneficiary?

Yes

No

1

1 2

2 3

3 4

4