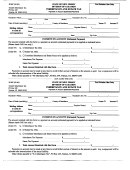

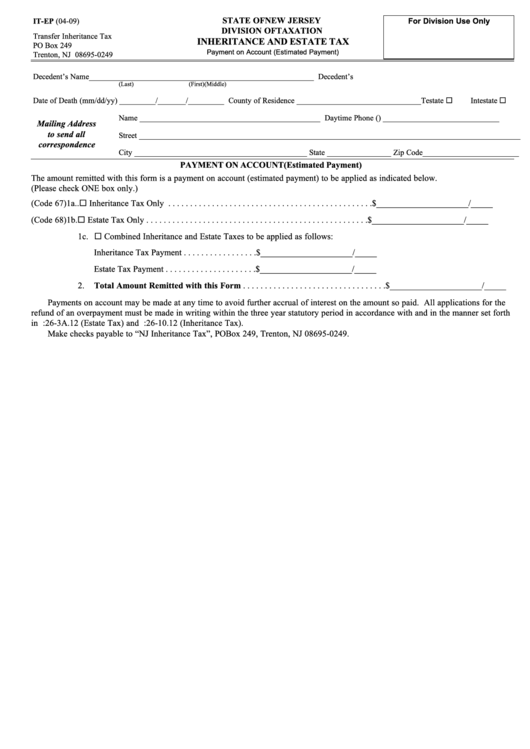

STATE OF NEW JERSEY

IT-EP (04-09)

For Division Use Only

DIVISION OF TAXATION

Transfer Inheritance Tax

INHERITANCE AND ESTATE TAX

PO Box 249

Payment on Account (Estimated Payment)

Trenton, NJ 08695-0249

Decedent’s Name________________________________________________________ Decedent’s S.S. No. ____________/__________/____________

(Last)

(First)

(Middle)

Date of Death (mm/dd/yy) _________/_______/_________ County of Residence _______________________________

Testate

Intestate

Name _____________________________________________ Daytime Phone (

) _____________________________

Mailing Address

to send all

Street _______________________________________________________________________________________________

correspondence

City ___________________________________________ State ________________ Zip Code ________________________

PAYMENT ON ACCOUNT (Estimated Payment)

The amount remitted with this form is a payment on account (estimated payment) to be applied as indicated below.

(Please check ONE box only.)

(Code 67)

1a..

Inheritance Tax Only . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_____________________/_____

(Code 68)

1b.

Estate Tax Only . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_____________________/_____

1c.

Combined Inheritance and Estate Taxes to be applied as follows:

Inheritance Tax Payment . . . . . . . . . . . . . . . . . $_____________________/_____

Estate Tax Payment . . . . . . . . . . . . . . . . . . . . . $_____________________/_____

2.

Total Amount Remitted with this Form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_____________________/_____

Payments on account may be made at any time to avoid further accrual of interest on the amount so paid. All applications for the

refund of an overpayment must be made in writing within the three year statutory period in accordance with and in the manner set forth

in N.J.A.C. 18:26-3A.12 (Estate Tax) and N.J.A.C. 18:26-10.12 (Inheritance Tax).

Make checks payable to “NJ Inheritance Tax”, PO Box 249, Trenton, NJ 08695-0249.

1

1