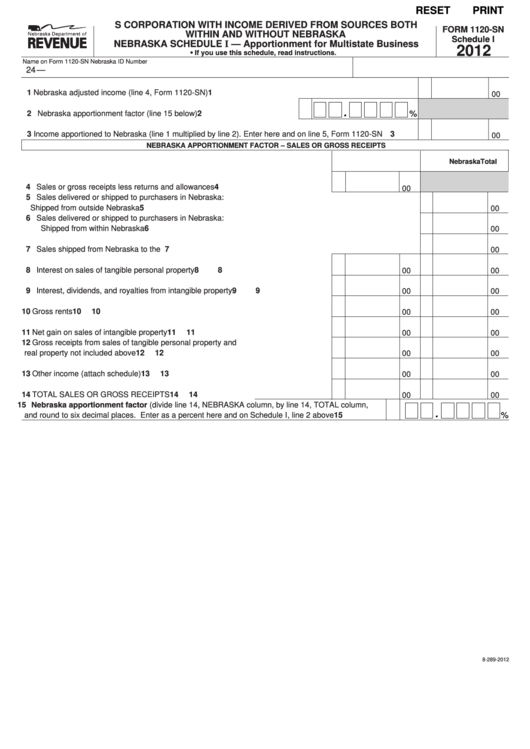

RESET

PRINT

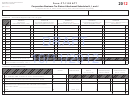

S CORPORATION WITH INCOME DERIVED FROM SOURCES BOTH

FORM 1120-SN

WITHIN AND WITHOUT NEBRASKA

Schedule I

NEBRASKA SCHEDULE I — Apportionment for Multistate Business

2012

• If you use this schedule, read instructions.

Name on Form 1120-SN

Nebraska ID Number

24 —

1 Nebraska adjusted income (line 4, Form 1120-SN) ............................................................................................... 1

00

.

2 Nebraska apportionment factor (line 15 below) .............................................

2

%

3 Income apportioned to Nebraska (line 1 multiplied by line 2). Enter here and on line 5, Form 1120-SN ............... 3

00

NEBRASKA APPORTIONMENT FACTOR – SALES OR GROSS RECEIPTS

Total

Nebraska

4 Sales or gross receipts less returns and allowances .....................................................

4

00

5 Sales delivered or shipped to purchasers in Nebraska:

Shipped from outside Nebraska .............................................................................................................................

5

00

6 Sales delivered or shipped to purchasers in Nebraska:

Shipped from within Nebraska ...............................................................................................................................

6

00

7 Sales shipped from Nebraska to the U.S. government ...........................................................................................

7

00

8 Interest on sales of tangible personal property ..............................................................

8

8

00

00

9 Interest, dividends, and royalties from intangible property .............................................

9

9

00

00

10 Gross rents ..................................................................................................................... 10

00

10

00

11 Net gain on sales of intangible property ......................................................................... 11

11

00

00

12 Gross receipts from sales of tangible personal property and

real property not included above .................................................................................... 12

12

00

00

13 Other income (attach schedule) ..................................................................................... 13

13

00

00

14 TOTAL SALES OR GROSS RECEIPTS ......................................................................... 14

00

14

00

15 Nebraska apportionment factor (divide line 14, NEBRASKA column, by line 14, TOTAL column,

.

%

and round to six decimal places. Enter as a percent here and on Schedule I, line 2 above ................... 15

8-289-2012

1

1 2

2 3

3