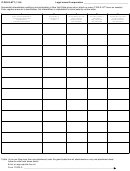

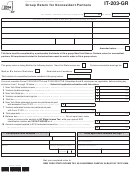

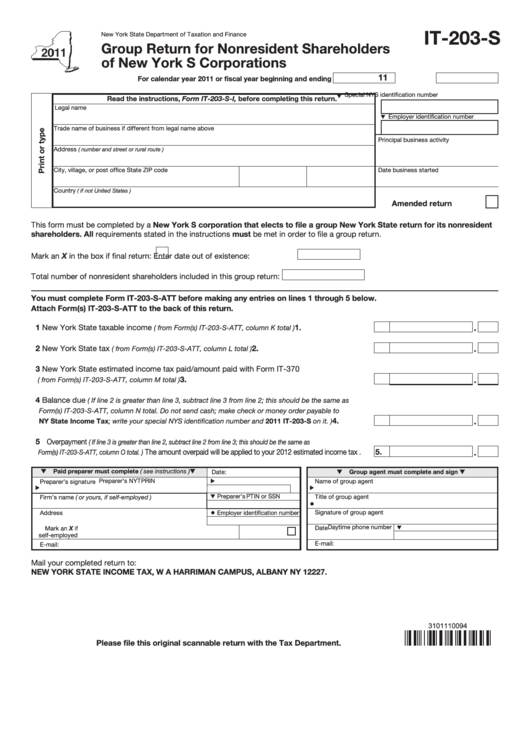

IT-203-S

New York State Department of Taxation and Finance

Group Return for Nonresident Shareholders

of New York S Corporations

1 1

For calendar year 2011 or fiscal year beginning

and ending

Special NYS identification number

Read the instructions, Form IT-203-S-I, before completing this return.

Legal name

Employer identification number

Trade name of business if different from legal name above

Principal business activity

Address

( number and street or rural route )

City, village, or post office

State

ZIP code

Date business started

Country

( if not United States )

Amended return .............

This form must be completed by a New York S corporation that elects to file a group New York State return for its nonresident

shareholders. All requirements stated in the instructions must be met in order to file a group return.

Mark an X in the box if final return:

Enter date out of existence:

Total number of nonresident shareholders included in this group return:

You must complete Form IT-203-S-ATT before making any entries on lines 1 through 5 below.

Attach Form(s) IT-203-S-ATT to the back of this return.

1 New York State taxable income

1.

...................................

( from Form(s) IT-203-S-ATT, column K total )

2 New York State tax

......................................................

2.

( from Form(s) IT-203-S-ATT, column L total )

3 New York State estimated income tax paid/amount paid with Form IT-370

..................................................................................

3.

( from Form(s) IT-203-S-ATT, column M total )

4 Balance due

( If line 2 is greater than line 3, subtract line 3 from line 2; this should be the same as

Form(s) IT-203-S-ATT, column N total. Do not send cash; make check or money order payable to

4.

............

NY State Income Tax; write your special NYS identification number and 2011 IT-203-S on it. )

5 Overpayment

( If line 3 is greater than line 2, subtract line 2 from line 3; this should be the same as

The amount overpaid will be applied to your 2012 estimated income tax .

5.

Form(s) IT-203-S-ATT, column O total. )

Paid preparer must complete ( see instructions )

Date:

Group agent must complete and sign

Preparer’s NYTPRIN

Name of group agent

Preparer’s signature

Preparer’s PTIN or SSN

Title of group agent

Firm’s name ( or yours, if self-employed )

Signature of group agent

Address

Employer identification number

Daytime phone number

Date

Mark an X if

self-employed

E-mail:

E-mail:

Mail your completed return to:

NEW YORK STATE INCOME TAX, W A HARRIMAN CAMPUS, ALBANY NY 12227.

3101110094

Please file this original scannable return with the Tax Department.

1

1