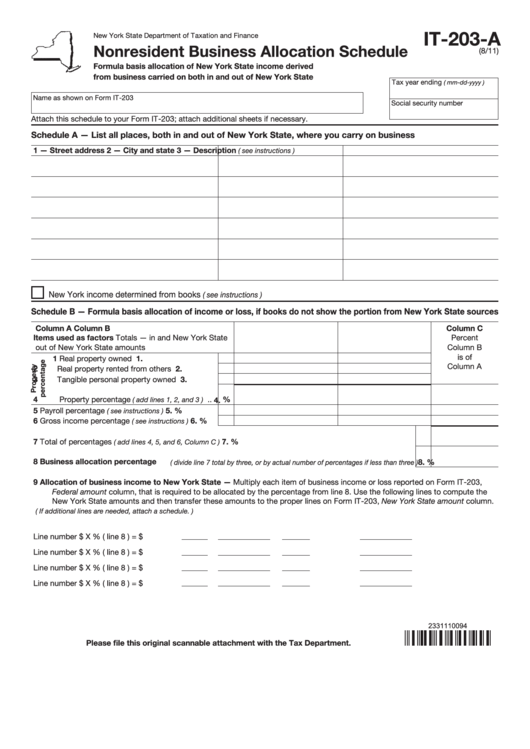

IT-203-A

New York State Department of Taxation and Finance

Nonresident Business Allocation Schedule

(8/11)

Formula basis allocation of New York State income derived

from business carried on both in and out of New York State

Tax year ending

( mm-dd-yyyy )

Name as shown on Form IT-203

Social security number

Attach this schedule to your Form IT-203; attach additional sheets if necessary.

Schedule A — List all places, both in and out of New York State, where you carry on business

1 — Street address

2 — City and state

3 — Description

( see instructions )

New York income determined from books

( see instructions )

Schedule B — Formula basis allocation of income or loss, if books do not show the portion from New York State sources

Column A

Column B

Column C

Items used as factors

Totals — in and

New York State

Percent

out of New York State

amounts

Column B

is of

1

1.

Real property owned ..................................

Column A

2

Real property rented from others ...............

2.

3

Tangible personal property owned .............

3.

4

%

Property percentage

..

( add lines 1, 2, and 3 )

4.

5

Payroll percentage

...................

5.

%

( see instructions )

6

6.

%

Gross income percentage

.......

( see instructions )

7

Total of percentages

....................................................................................

7.

%

( add lines 4, 5, and 6, Column C )

8

Business allocation percentage

8.

%

( divide line 7 total by three, or by actual number of percentages if less than three )

9

Allocation of business income to New York State — Multiply each item of business income or loss reported on Form IT-203,

Federal amount column, that is required to be allocated by the percentage from line 8. Use the following lines to compute the

New York State amounts and then transfer these amounts to the proper lines on Form IT-203, New York State amount column.

( If additional lines are needed, attach a schedule. )

Line number

$

X

% ( line 8 ) = $

Line number

$

X

% ( line 8 ) = $

Line number

$

X

% ( line 8 ) = $

Line number

$

X

% ( line 8 ) = $

2331110094

Please file this original scannable attachment with the Tax Department.

1

1 2

2