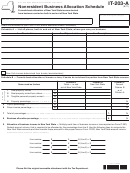

Instructions

IT-203-A (8/11) (back)

General instructions

times the gross rent payable during the tax year for which the return is filed.

Gross rent includes:

An allocation of business income must be made if you are a nonresident

— any amount payable for the use or possession of real property, or

and you carry on business both in and out of New York State. Business is

any part of it, whether designated as a fixed sum of money or as a

carried on out of the state if you have, maintain, operate, or occupy desk

percentage of sales, profits, or otherwise;

space, an office, a shop, a store, a warehouse, a factory, an agency, or

other place where your business matters are systematically and regularly

— any amount payable as additional rent or in lieu of rent, such as interest,

carried on outside New York State.

taxes, insurance, repairs, or any other amount required to be paid by

the terms of a lease or other agreement; and

An occasional or isolated business transaction out of the state will not

permit an allocation of income. In addition, if you have no regular place of

— a proportion of the cost of any improvement to real property made by

business out of the state, you may not allocate any income for business

or on behalf of the business which reverts to the owner or lessor upon

carried on out of the state even though you or your representatives

termination of a lease or other arrangement. However, if a building is

may travel out of the state to perform duties connected with the trade

erected on leased land by or on behalf of the business, the value of the

or business and may make sales or perform services for out-of-state

building is determined in the same manner as if it were owned by the

individuals or corporations.

business.

If you carry on business both in and out of New York State and maintain

Enter the value of all real property rented in Column A and the value of real

accounts clearly showing income from the New York business, complete

property rented that is located in New York State in Column B.

Schedule A of Form IT-203-A, and mark an X in the box for New York

Line 3 Tangible personal property owned — Enter in Column A the

income determined from books. Do not complete Schedule B.

average value of all tangible personal property owned by the business. Enter in

If the New York income of the business cannot be determined from your

Column B the average value of tangible personal property located in New York

books, you must determine income from business carried on both in

State.

and out of New York State in accordance with the statutory formula or

Line 4 — Add lines 1, 2, and 3 in Column A and Column B, and enter the

an alternative method approved by the New York State Commissioner of

results at line 4.

Taxation and Finance. Complete Schedules A and B following the specific

instructions on this page. Even though Schedule B may not fairly reflect the

Divide the Column B amount by the Column A amount. Round the result

income from New York and you use an alternative allocation method, you

to the fourth decimal place and enter it as a percentage in Column C. For

must complete Schedule B. Attach a detailed explanation of the alternative

example .3333 should be entered as 33.33.

method used to determine New York income, together with full details of

Line 5 Payroll percentage — Enter wages, salaries, and other personal

any modifications increasing or decreasing the amount of New York income

service compensation paid only to employees of the business. Do not

computed by the alternate method. The modifications are described in the

include payments to independent contractors, independent sales agents,

instructions for Form IT-203.

etc. Enter in Column A the total compensation paid to employees during

The business allocation percentage or alternate method is not applied to

the tax year in connection with business operations carried on both in and

income from the rental of real property or gains or losses from the sale of

out of New York State. Enter in Column B the amount paid in connection

real property. The entire rental income from New York State real property or

with operations carried on in New York State. The compensation paid for

gain from the sale of such property is taxable and the entire amount of any

services is in connection with operations carried on in New York State if

loss is deductible. Rental income from real property located outside New

the employee works in or travels out of an office or other place of business

York State or gain from the sale of this property is not taxable. Any loss

located in New York State.

connected with such property is not deductible.

Divide the Column B amount by the Column A amount. Round the result

The business allocation percentage is to be applied to Form IT-203

to the fourth decimal place and enter it as a percentage in Column C. For

business income loss, farm income loss, or income from intangible

example .3333 should be entered as 33.33.

personal property (such as annuities, dividends, interest, and gains from

Line 6 Gross income percentage — Enter in Column A total gross sales

the disposition of intangible personal property) if such property is used in or

made or charges for services performed by the proprietor or by employees,

connected with a business carried on both in and out of New York State.

agents, agencies, or independent contractors of the business in and out

If you carried on more than one business for which an allocation is required

of New York State. Enter in Column B the portion of total gross sales

on Form IT-203-A, prepare a separate Form IT-203-A for each business and

or charges which represents sales made, or services performed, by or

attach it to Form IT-203.

through an agency in New York State. This includes sales made or services

performed by employees, agents, agencies, or independent contractors

Specific instructions

situated at, connected with, or sent out from offices of the business (or its

agencies) located in New York State. For example, if a salesman working

Schedule A — In columns 1 and 2, list the exact locations at which you

out of the New York office of the business covers New York, New Jersey

carry on business both in and out of New York State. In column 3, describe

and Pennsylvania, all sales made by him are to be allocated to New York

the places listed in columns 1 and 2 (e.g., branch office, agency, factory,

State and included in Column B on line 6.

warehouse, etc.) and state whether you rent or own these places. If you

need additional space, attach a separate sheet(s) to your Form IT-203-A

Divide the Column B amount by the Column A amount. Round the result

with the same format as Schedule A that clearly shows the information for

to the fourth decimal place and enter it as a percentage in Column C. For

columns 1 through 3.

example .3333 should be entered as 33.33.

Schedule B — Complete this schedule if business is carried on both in and

Line 7 Total of percentages — Add lines 4, 5, and 6 in Column C and

out of New York State and you do not maintain accounts clearly reflecting

enter the total.

the New York operations of the business.

Line 8 Business allocation percentage — Divide line 7 by three (or by

Property percentage — Complete lines 1, 2, 3, and 4 of Schedule B to

the actual number of percentages if less than three). Round the result to the

determine the average value of real and tangible personal property of the

fourth decimal place and enter the result as a percentage.

business.

Line 9 Allocation of business income to New York State — Multiply

Line 1 Real property owned — Enter in Column A the average value of

each item of business income or loss reported on Form IT-203, Federal

all real property owned by the business. Enter in Column B the average

amount column, which is required to be allocated by the percentage

value of real property located in New York State.

from line 8. Transfer the New York State amounts to the proper lines on

Form IT-203, New York State amount column.

The average value of the property is determined by (1) adding its adjusted

basis at the beginning of the tax year to its adjusted basis at the end of the

tax year and (2) dividing by two.

Line 2 Real property rented from others — The fair market value of

real property rented by the business and to be included in line 2 is eight

2332110094

Please file this original scannable attachment with the Tax Department.

1

1 2

2