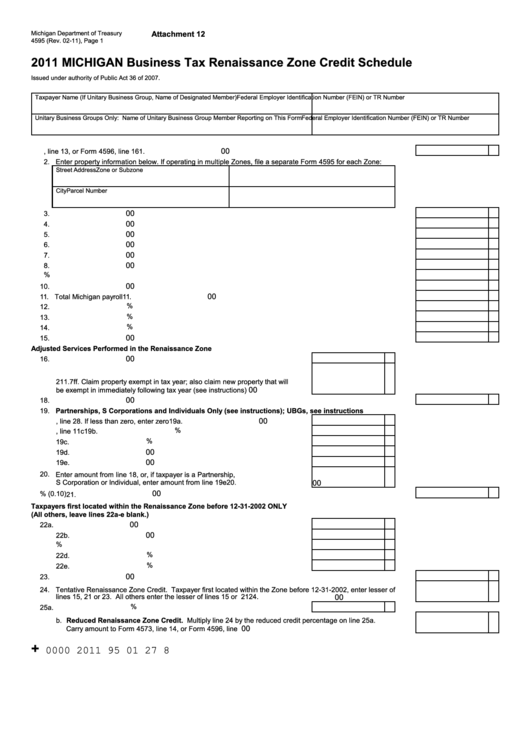

Form 4595 - Michigan Business Tax Renaissance Zone Credit Schedule - 2011

ADVERTISEMENT

Attachment 12

Michigan Department of Treasury

4595 (Rev. 02-11), Page 1

2011 MICHIGAN Business Tax Renaissance Zone Credit Schedule

Issued under authority of Public Act 36 of 2007.

Taxpayer Name (If Unitary Business Group, Name of Designated Member)

Federal Employer Identification Number (FEIN) or TR Number

Unitary Business Groups Only: Name of Unitary Business Group Member Reporting on This Form

Federal Employer Identification Number (FEIN) or TR Number

00

1. Tax liability before Renaissance Zone Credit. Enter amount from Form 4573, line 13, or Form 4596, line 16 .....

1.

2. Enter property information below. If operating in multiple Zones, file a separate Form 4595 for each Zone:

Street Address

Zone or Subzone

City

Parcel Number

00

3. Average value of property owned within the Zone .................................................................................................

3.

00

4. Multiply rent paid for property within the Zone by 8 and enter the result ................................................................

4.

00

5. Total property value within the Zone. Add lines 3 and 4 .........................................................................................

5.

00

6. Average value of all property owned in Michigan ...................................................................................................

6.

00

7. Multiply rent paid for property in Michigan by 8 and enter the result ......................................................................

7.

00

8. Total property value in Michigan. Add lines 6 and 7 ...............................................................................................

8.

%

9. Divide line 5 by line 8 and enter as a percentage...................................................................................................

9.

00

10. Total payroll for services performed within the Zone ..............................................................................................

10.

00

11. Total Michigan payroll .............................................................................................................................................

11.

%

12. Divide line 10 by line 11 and enter as a percentage ...............................................................................................

12.

%

13. Add lines 9 and 12 and enter as a percentage .......................................................................................................

13.

%

14. Business Activity Factor. Divide line 13 by 2 and enter as a percentage ...............................................................

14.

00

15. Credit based on the Business Activity Factor. Multiply line 14 by line 1 .................................................................

15.

Adjusted Services Performed in the Renaissance Zone

00

16. Enter amount from line 10 ................................................................................

16.

17. Enter depreciation for tangible property in the Zone exempt under MCL

211.7ff. Claim property exempt in tax year; also claim new property that will

00

be exempt in immediately following tax year (see instructions)........................

17.

00

18. Add lines 16 and 17 ...........................................................................................................................................

18.

19. Partnerships, S Corporations and Individuals Only (see instructions); UBGs, see instructions

00

a. Business income from Form 4567, line 28. If less than zero, enter zero ........ 19a.

%

b. Apportionment percentage from Form 4567, line 11c ................................. 19b.

%

c. Enter percentage from line 14 ..................................................................... 19c.

00

d. Multiply line 19a by line 19b by line 19c ...................................................... 19d.

00

e. Add lines 18 and 19d ................................................................................... 19e.

20. Enter amount from line 18, or, if taxpayer is a Partnership,

S Corporation or Individual, enter amount from line 19e ..................................

20.

00

00

21. Credit based on adjusted services performed in the Zone. Multiply line 20 by 10% (0.10) ...............................

21.

Taxpayers first located within the Renaissance Zone before 12-31-2002 ONLY

(All others, leave lines 22a-e blank.)

00

22. a. Renaissance Zone Credit allowed in 2007 .................................................. 22a.

00

b. Michigan payroll in 2007 .............................................................................. 22b.

%

c. Business Activity Factor for tax year 2007 and enter as a percentage........ 22c.

%

d. Divide line 11 by line 22b and enter as a percentage .................................. 22d.

%

e. Divide line 14 by line 22c and enter as a percentage .................................. 22e.

00

23. Multiply line 22a by line 22d by line 22e ...........................................................................................................

23.

24. Tentative Renaissance Zone Credit. Taxpayer first located within the Zone before 12-31-2002, enter lesser of

lines 15, 21 or 23. All others enter the lesser of lines 15 or 21 ............................................................................

24.

00

%

25. a. Reduced credit percentage from Reduced Credit Table on page 2 ............. 25a.

b. Reduced Renaissance Zone Credit. Multiply line 24 by the reduced credit percentage on line 25a.

00

Carry amount to Form 4573, line 14, or Form 4596, line 17............................................................................

25b.

+

0000 2011 95 01 27 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4