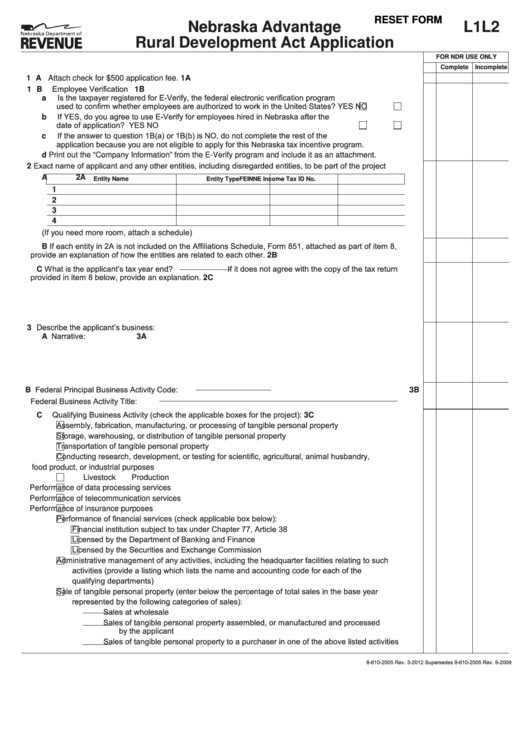

RESET FORM

Nebraska Advantage

L1L2

Rural Development Act Application

FOR NDR USE ONLY

Complete

Incomplete

1 A

Attach check for $500 application fee.

1A

1 B Employee Verification

1B

Is the taxpayer registered for E-Verify, the federal electronic verification program

a

used to confirm whether employees are authorized to work in the United States?

YES

NO

If YES, do you agree to use E-Verify for employees hired in Nebraska after the

b

date of application?

YES

NO

If the answer to question 1B(a) or 1B(b) is NO, do not complete the rest of the

c

application because you are not eligible to apply for this Nebraska tax incentive program.

d

Print out the “Company Information” from the E-Verify program and include it as an attachment.

2 Exact name of applicant and any other entities, including disregarded entities, to be part of the project

A

2A

Entity Name

Entity Type

FEIN

NE Income Tax ID No.

1

2

3

4

(If you need more room, attach a schedule)

If each entity in 2A is not included on the Affiliations Schedule, Form 851, attached as part of item 8,

B

provide an explanation of how the entities are related to each other.

2B

C What is the applicant’s tax year end? If it does not agree with the copy of the tax return

provided in item 8 below, provide an explanation.

2C

3 Describe the applicant’s business:

A Narrative:

3A

Federal Principal Business Activity Code:

B

3B

Federal Business Activity Title:

C Qualifying Business Activity (check the applicable boxes for the project):

3C

Assembly, fabrication, manufacturing, or processing of tangible personal property

Storage, warehousing, or distribution of tangible personal property

Transportation of tangible personal property

Conducting research, development, or testing for scientific, agricultural, animal husbandry,

food product, or industrial purposes

Livestock Production

Performance of data processing services

Performance of telecommunication services

Performance of insurance purposes

Performance of financial services (check applicable box below):

Financial institution subject to tax under Chapter 77, Article 38

Licensed by the Department of Banking and Finance

Licensed by the Securities and Exchange Commission

Administrative management of any activities, including the headquarter facilities relating to such

activities (provide a listing which lists the name and accounting code for each of the

qualifying departments)

Sale of tangible personal property (enter below the percentage of total sales in the base year

represented by the following categories of sales):

Sales at wholesale

Sales of tangible personal property assembled, or manufactured and processed

by the applicant

Sales of tangible personal property to a purchaser in one of the above listed activities

8-610-2005 Rev. 3-2012 Supersedes 8-610-2005 Rev. 9-2009

1

1 2

2