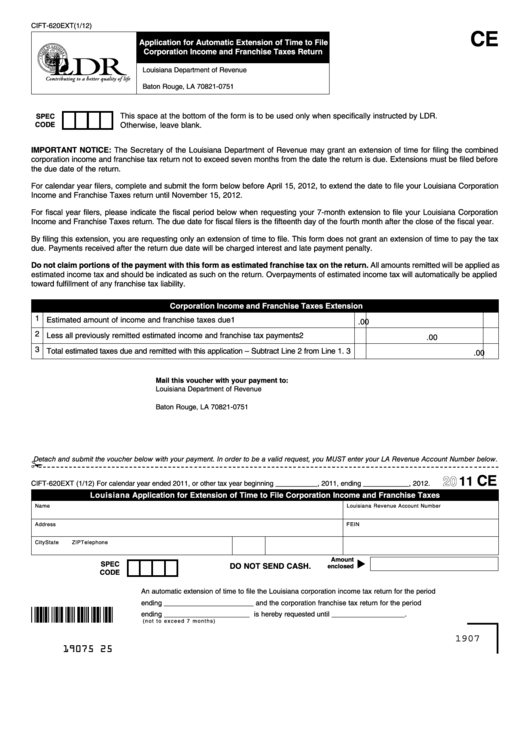

CIFT-620EXT(1/12)

CE

Application for Automatic Extension of Time to File

Corporation Income and Franchise Taxes Return

Louisiana Department of Revenue

P.O. Box 751

Baton Rouge, LA 70821-0751

This space at the bottom of the form is to be used only when specifically instructed by LDR.

SPEC

CODE

Otherwise, leave blank.

ImPORTAnT nOTICE: The Secretary of the Louisiana Department of Revenue may grant an extension of time for filing the combined

corporation income and franchise tax return not to exceed seven months from the date the return is due. Extensions must be filed before

the due date of the return.

For calendar year filers, complete and submit the form below before April 15, 2012, to extend the date to file your Louisiana Corporation

Income and Franchise Taxes return until November 15, 2012.

For fiscal year filers, please indicate the fiscal period below when requesting your 7-month extension to file your Louisiana Corporation

Income and Franchise Taxes return. The due date for fiscal filers is the fifteenth day of the fourth month after the close of the fiscal year.

By filing this extension, you are requesting only an extension of time to file. This form does not grant an extension of time to pay the tax

due. Payments received after the return due date will be charged interest and late payment penalty.

Do not claim portions of the payment with this form as estimated franchise tax on the return. All amounts remitted will be applied as

estimated income tax and should be indicated as such on the return. Overpayments of estimated income tax will automatically be applied

toward fulfillment of any franchise tax liability.

Corporation Income and Franchise Taxes Extension

1 Estimated amount of income and franchise taxes due

1

.00

2 Less all previously remitted estimated income and franchise tax payments

2

.00

3 Total estimated taxes due and remitted with this application – Subtract Line 2 from Line 1.

3

.00

mail this voucher with your payment to:

Louisiana Department of Revenue

P.O. Box 751

Baton Rouge, LA 70821-0751

Detach and submit the voucher below with your payment. In order to be a valid request, you MUST enter your LA Revenue Account Number below.

✁

CE

11

CIFT-620EXT (1/12) For calendar year ended 2011, or other tax year beginning ___________, 2011, ending ____________, 2012.

Louisiana Application for Extension of Time to File Corporation Income and Franchise Taxes

Name

Louisiana Revenue Account Number

Address

FEIN

City

State

ZIP

Telephone

Amount

u

SPEC

DO nOT SEnD CASh.

enclosed

CODE

An automatic extension of time to file the Louisiana corporation income tax return for the period

ending _______________________ and the corporation franchise tax return for the period

ending ______________________ is hereby requested until ___________________.

( n o t t o e x c e e d 7 m o n t h s )

1907

19075

25

1

1