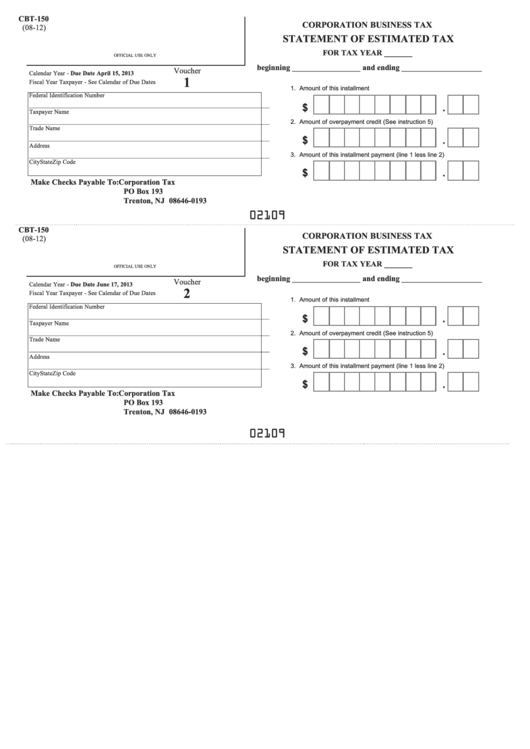

CBT-150

CORPORATION BUSINESS TAX

(08-12)

STATEMENT OF ESTIMATED TAX

FOR TAX YEAR _______

OFFICIAL USE ONLY

beginning _________________ and ending ____________________

Voucher

Calendar Year - Due Date April 15, 2013

1

Fiscal Year Taxpayer - See Calendar of Due Dates

1. Amount of this installment

Federal Identification Number

____________________________________________________________________________

$

.

Taxpayer Name

____________________________________________________________________________

2. Amount of overpayment credit (See instruction 5)

Trade Name

____________________________________________________________________________

$

.

Address

3. Amount of this installment payment (line 1 less line 2)

____________________________________________________________________________

City

State

Zip Code

$

.

Make Checks Payable To: Corporation Tax

PO Box 193

Trenton, NJ 08646-0193

02109

CBT-150

CORPORATION BUSINESS TAX

(08-12)

STATEMENT OF ESTIMATED TAX

FOR TAX YEAR _______

OFFICIAL USE ONLY

beginning _________________ and ending ____________________

Voucher

Calendar Year - Due Date June 17, 2013

2

Fiscal Year Taxpayer - See Calendar of Due Dates

1. Amount of this installment

Federal Identification Number

____________________________________________________________________________

$

.

Taxpayer Name

____________________________________________________________________________

2. Amount of overpayment credit (See instruction 5)

Trade Name

____________________________________________________________________________

$

.

Address

3. Amount of this installment payment (line 1 less line 2)

____________________________________________________________________________

City

State

Zip Code

$

.

Make Checks Payable To: Corporation Tax

PO Box 193

Trenton, NJ 08646-0193

02109

1

1 2

2 3

3 4

4