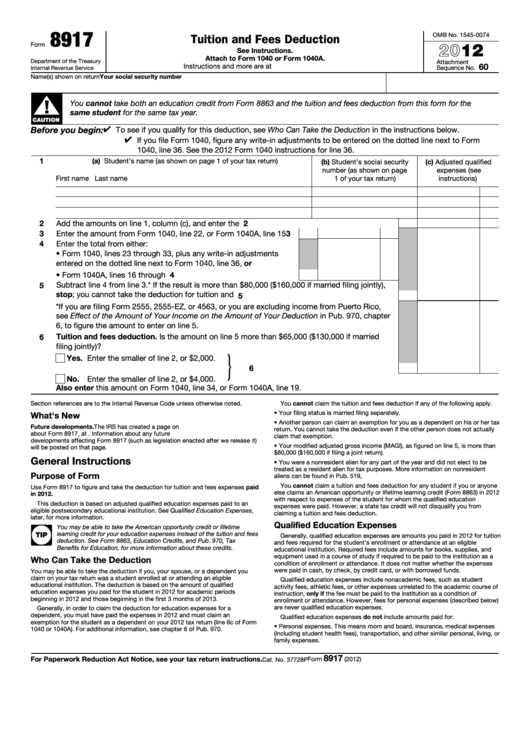

8917

OMB No. 1545-0074

Tuition and Fees Deduction

2012

Form

See Instructions.

Attach to Form 1040 or Form 1040A.

Department of the Treasury

Attachment

60

Instructions and more are at

Sequence No.

Internal Revenue Service

Your social security number

Name(s) shown on return

▲

!

You cannot take both an education credit from Form 8863 and the tuition and fees deduction from this form for the

same student for the same tax year.

CAUTION

Before you begin:

✔

To see if you qualify for this deduction, see Who Can Take the Deduction in the instructions below.

✔

If you file Form 1040, figure any write-in adjustments to be entered on the dotted line next to Form

1040, line 36. See the 2012 Form 1040 instructions for line 36.

1

(a) Student’s name (as shown on page 1 of your tax return)

(b) Student’s social security

(c) Adjusted qualified

number (as shown on page

expenses (see

First name

Last name

1 of your tax return)

instructions)

2

Add the amounts on line 1, column (c), and enter the total .

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Enter the amount from Form 1040, line 22, or Form 1040A, line 15

3

4

Enter the total from either:

• Form 1040, lines 23 through 33, plus any write-in adjustments

entered on the dotted line next to Form 1040, line 36, or

• Form 1040A, lines 16 through 18.

.

.

.

.

.

.

.

.

.

.

4

Subtract line 4 from line 3.* If the result is more than $80,000 ($160,000 if married filing jointly),

5

stop; you cannot take the deduction for tuition and fees

.

.

.

.

.

.

.

.

.

.

.

.

.

5

*If you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from Puerto Rico,

see Effect of the Amount of Your Income on the Amount of Your Deduction in Pub. 970, chapter

6, to figure the amount to enter on line 5.

Tuition and fees deduction. Is the amount on line 5 more than $65,000 ($130,000 if married

6

filing jointly)?

}

Yes. Enter the smaller of line 2, or $2,000.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

No. Enter the smaller of line 2, or $4,000.

Also enter this amount on Form 1040, line 34, or Form 1040A, line 19.

Section references are to the Internal Revenue Code unless otherwise noted.

You cannot claim the tuition and fees deduction if any of the following apply.

• Your filing status is married filing separately.

What's New

• Another person can claim an exemption for you as a dependent on his or her tax

Future developments. The IRS has created a page on IRS.gov for information

return. You cannot take the deduction even if the other person does not actually

about Form 8917, at Information about any future

claim that exemption.

developments affecting Form 8917 (such as legislation enacted after we release it)

• Your modified adjusted gross income (MAGI), as figured on line 5, is more than

will be posted on that page.

$80,000 ($160,000 if filing a joint return).

General Instructions

• You were a nonresident alien for any part of the year and did not elect to be

treated as a resident alien for tax purposes. More information on nonresident

Purpose of Form

aliens can be found in Pub. 519, U.S. Tax Guide for Aliens.

You cannot claim a tuition and fees deduction for any student if you or anyone

Use Form 8917 to figure and take the deduction for tuition and fees expenses paid

else claims an American opportunity or lifetime learning credit (Form 8863) in 2012

in 2012.

with respect to expenses of the student for whom the qualified education

This deduction is based on adjusted qualified education expenses paid to an

expenses were paid. However, a state tax credit will not disqualify you from

eligible postsecondary educational institution. See Qualified Education Expenses,

claiming a tuition and fees deduction.

later, for more information.

Qualified Education Expenses

You may be able to take the American opportunity credit or lifetime

learning credit for your education expenses instead of the tuition and fees

TIP

Generally, qualified education expenses are amounts you paid in 2012 for tuition

deduction. See Form 8863, Education Credits, and Pub. 970, Tax

and fees required for the student’s enrollment or attendance at an eligible

Benefits for Education, for more information about these credits.

educational institution. Required fees include amounts for books, supplies, and

equipment used in a course of study if required to be paid to the institution as a

Who Can Take the Deduction

condition of enrollment or attendance. It does not matter whether the expenses

were paid in cash, by check, by credit card, or with borrowed funds.

You may be able to take the deduction if you, your spouse, or a dependent you

claim on your tax return was a student enrolled at or attending an eligible

Qualified education expenses include nonacademic fees, such as student

educational institution. The deduction is based on the amount of qualified

activity fees, athletic fees, or other expenses unrelated to the academic course of

education expenses you paid for the student in 2012 for academic periods

instruction, only if the fee must be paid to the institution as a condition of

beginning in 2012 and those beginning in the first 3 months of 2013.

enrollment or attendance. However, fees for personal expenses (described below)

are never qualified education expenses.

Generally, in order to claim the deduction for education expenses for a

dependent, you must have paid the expenses in 2012 and must claim an

Qualified education expenses do not include amounts paid for:

exemption for the student as a dependent on your 2012 tax return (line 6c of Form

• Personal expenses. This means room and board, insurance, medical expenses

1040 or 1040A). For additional information, see chapter 6 of Pub. 970.

(including student health fees), transportation, and other similar personal, living, or

family expenses.

8917

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2012)

Cat. No. 37728P

1

1 2

2