Reset

Print Form

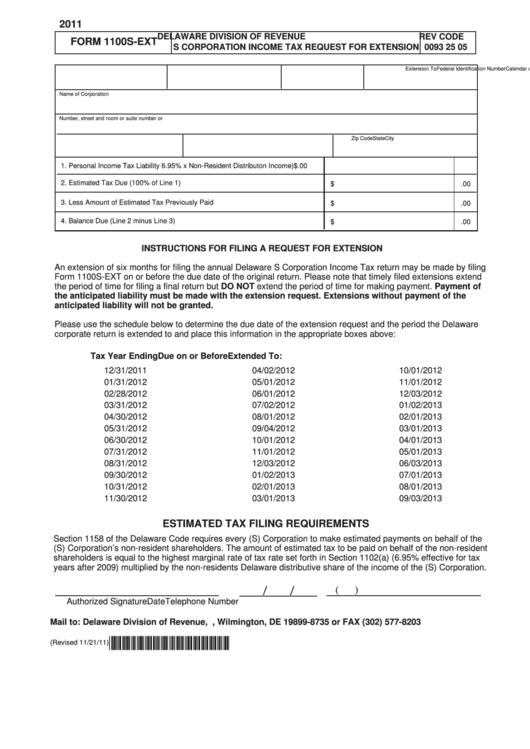

2011

DELAWARE DIVISION OF REVENUE

REV CODE

FORM 1100S-EXT

S CORPORATION INCOME TAX REQUEST FOR EXTENSION

0093 25 05

Federal Identification Number

Calendar or Fiscal Year Ending

Due on or Before

Extension To

Name of Corporation

Number, street and room or suite number or P.O. Box

City

State

Zip Code

1. Personal Income Tax Liability 6.95% x Non-Resident Distributon Income)

$

.00

2. Estimated Tax Due (100% of Line 1)

$

.00

3. Less Amount of Estimated Tax Previously Paid

$

.00

4. Balance Due (Line 2 minus Line 3)

$

.00

INSTRUCTIONS FOR FILING A REQUEST FOR EXTENSION

An extension of six months for filing the annual Delaware S Corporation Income Tax return may be made by filing

Form 1100S-EXT on or before the due date of the original return. Please note that timely filed extensions extend

the period of time for filing a final return but DO NOT extend the period of time for making payment. Payment of

the anticipated liability must be made with the extension request. Extensions without payment of the

anticipated liability will not be granted.

Please use the schedule below to determine the due date of the extension request and the period the Delaware

corporate return is extended to and place this information in the appropriate boxes above:

Tax Year Ending

Due on or Before

Extended To:

12/31/2011

04/02/2012

10/01/2012

01/31/2012

05/01/2012

11/01/2012

02/28/2012

06/01/2012

12/03/2012

03/31/2012

07/02/2012

01/02/2013

04/30/2012

08/01/2012

02/01/2013

05/31/2012

09/04/2012

03/01/2013

06/30/2012

10/01/2012

04/01/2013

07/31/2012

11/01/2012

05/01/2013

08/31/2012

12/03/2012

06/03/2013

09/30/2012

01/02/2013

07/01/2013

10/31/2012

02/01/2013

08/01/2013

11/30/2012

03/01/2013

09/03/2013

ESTIMATED TAX FILING REQUIREMENTS

Section 1158 of the Delaware Code requires every (S) Corporation to make estimated payments on behalf of the

(S) Corporation’s non-resident shareholders. The amount of estimated tax to be paid on behalf of the non-resident

shareholders is equal to the highest marginal rate of tax rate set forth in Section 1102(a) (6.95% effective for tax

years after 2009) multiplied by the non-residents Delaware distributive share of the income of the (S) Corporation.

(

)

Authorized Signature

Date

Telephone Number

Mail to: Delaware Division of Revenue, P.O. Box 8735, Wilmington, DE 19899-8735 or FAX (302) 577-8203

*DF11611019999*

(Revised 11/21/11)

1

1