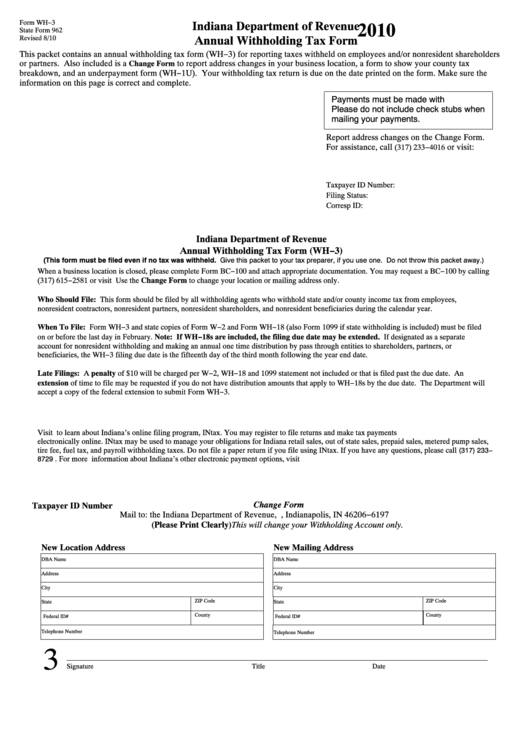

Form WH−3

Indiana Department of Revenue

2010

State Form 962

Annual Withholding Tax Form

Revised 8/10

This packet contains an annual withholding tax form (WH−3) for reporting taxes withheld on employees and/or nonresident shareholders

or partners. Also included is a

to report address changes in your business location, a form to show your county tax

Change Form

breakdown, and an underpayment form (WH−1U). Your withholding tax return is due on the date printed on the form. Make sure the

information on this page is correct and complete.

Payments must be made with U.S. funds.

Please do not include check stubs when

mailing your payments.

Report address changes on the Change Form.

For assistance, call

or visit:

(317) 233−4016

Taxpayer ID Number:

Filing Status:

Corresp ID:

Indiana Department of Revenue

Annual Withholding Tax Form (WH−3)

(This form must be filed even if no tax was withheld. Give this packet to your tax preparer, if you use one. Do not throw this packet away.)

When a business location is closed, please complete Form BC−100 and attach appropriate documentation. You may request a BC−100 by calling

(317) 615−2581 or visit

Use the Change Form to change your location or mailing address only.

Who Should File: This form should be filed by all withholding agents who withhold state and/or county income tax from employees,

nonresident contractors, nonresident partners, nonresident shareholders, and nonresident beneficiaries during the calendar year.

When To File: Form WH−3 and state copies of Form W−2 and Form WH−18 (also Form 1099 if state withholding is included) must be filed

on or before the last day in February. Note: If WH−18s are included, the filing due date may be extended. If designated as a separate

account for nonresident withholding and making an annual one time distribution by pass through entities to shareholders, partners, or

beneficiaries, the WH−3 filing due date is the fifteenth day of the third month following the year end date.

Late Filings: A penalty of $10 will be charged per W−2, WH−18 and 1099 statement not included or that is filed past the due date. An

extension of time to file may be requested if you do not have distribution amounts that apply to WH−18s by the due date. The Department will

accept a copy of the federal extension to submit Form WH−3.

Visit

to learn about Indiana’s online filing program, INtax. You may register to file returns and make tax payments

electronically online. INtax may be used to manage your obligations for Indiana retail sales, out of state sales, prepaid sales, metered pump sales,

tire fee, fuel tax, and payroll withholding taxes. Do not file a paper return if you file using INtax. If you have any questions, please call

(317) 233−

. For more information about Indiana’s other electronic payment options, visit /epay/index.html

8729

Change Form

Taxpayer ID Number

Mail to: the Indiana Department of Revenue, P.O. Box 6197, Indianapolis, IN 46206−6197

(Please Print Clearly) This will change your Withholding Account only.

New Location Address

New Mailing Address

DBA Name

DBA Name

Address

Address

City

City

ZIP Code

ZIP Code

State

State

County

County

Federal ID#

Federal ID#

Telephone Number

Telephone Number

3

Signature

Title

Date

1

1 2

2 3

3 4

4