Form 740np-Wh - Application For Six-Month Extension Of Time

ADVERTISEMENT

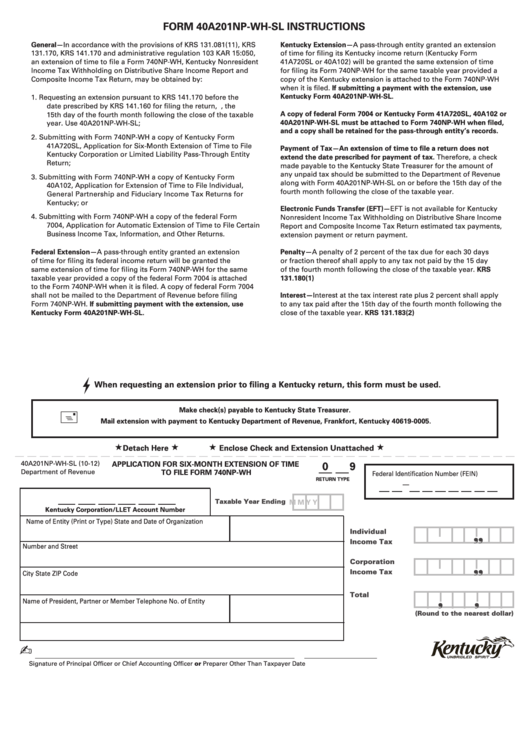

FORM 40A201NP-WH-SL INSTRUCTIONS

General—In accordance with the provisions of KRS 131.081(11), KRS

Kentucky Extension—A pass-through entity granted an extension

131.170, KRS 141.170 and administrative regulation 103 KAR 15:050,

of time for filing its Kentucky income return (Kentucky Form

an extension of time to file a Form 740NP-WH, Kentucky Nonresident

41A720SL or 40A102) will be granted the same extension of time

Income Tax Withholding on Distributive Share Income Report and

for filing its Form 740NP-WH for the same taxable year provided a

Composite Income Tax Return, may be obtained by:

copy of the Kentucky extension is attached to the Form 740NP-WH

when it is filed. If submitting a payment with the extension, use

Kentucky Form 40A201NP-WH-SL.

1.

Requesting an extension pursuant to KRS 141.170 before the

date prescribed by KRS 141.160 for filing the return, i.e., the

A copy of federal Form 7004 or Kentucky Form 41A720SL, 40A102 or

15th day of the fourth month following the close of the taxable

40A201NP-WH-SL must be attached to Form 740NP-WH when filed,

year. Use 40A201NP-WH-SL;

and a copy shall be retained for the pass-through entity’s records.

2.

Submitting with Form 740NP-WH a copy of Kentucky Form

41A720SL, Application for Six-Month Extension of Time to File

Payment of Tax—An extension of time to file a return does not

Kentucky Corporation or Limited Liability Pass-Through Entity

extend the date prescribed for payment of tax. Therefore, a check

Return;

made payable to the Kentucky State Treasurer for the amount of

any unpaid tax should be submitted to the Department of Revenue

3.

Submitting with Form 740NP-WH a copy of Kentucky Form

along with Form 40A201NP-WH-SL on or before the 15th day of the

40A102, Application for Extension of Time to File Individual,

fourth month following the close of the taxable year.

General Partnership and Fiduciary Income Tax Returns for

Kentucky; or

Electronic Funds Transfer (EFT)—EFT is not available for Kentucky

4.

Submitting with Form 740NP-WH a copy of the federal Form

Nonresident Income Tax Withholding on Distributive Share Income

7004, Application for Automatic Extension of Time to File Certain

Report and Composite Income Tax Return estimated tax payments,

Business Income Tax, Information, and Other Returns.

extension payment or return payment.

Federal Extension—A pass-through entity granted an extension

Penalty—A penalty of 2 percent of the tax due for each 30 days

of time for filing its federal income return will be granted the

or fraction thereof shall apply to any tax not paid by the 15 day

same extension of time for filing its Form 740NP-WH for the same

of the fourth month following the close of the taxable year. KRS

taxable year provided a copy of the federal Form 7004 is attached

131.180(1)

to the Form 740NP-WH when it is filed. A copy of federal Form 7004

shall not be mailed to the Department of Revenue before filing

Interest—Interest at the tax interest rate plus 2 percent shall apply

Form 740NP-WH. If submitting payment with the extension, use

to any tax paid after the 15th day of the fourth month following the

close of the taxable year. KRS 131.183(2)

Kentucky Form 40A201NP-WH-SL.

When requesting an extension prior to filing a Kentucky return, this form must be used.

Make check(s) payable to Kentucky State Treasurer.

Mail extension with payment to Kentucky Department of Revenue, Frankfort, Kentucky 40619-0005.

Detach Here

Enclose Check and Extension Unattached

40A201NP-WH-SL (10-12)

__ __

0 9

APPLICATION FOR SIX-MONTH EXTENSION OF TIME

Department of Revenue

TO FILE FORM 740NP-WH

Federal Identification Number (FEIN)

RETURN TYPE

—

Taxable Year Ending

M M Y

Y

Kentucky Corporation/LLET Account Number

Name of Entity (Print or Type)

State and Date of Organization

Individual

❜

❜

Income Tax

Number and Street

Corporation

Income Tax

❜

❜

City

State

ZIP Code

Total

Name of President, Partner or Member

Telephone No. of Entity

❜

❜

(Round to the nearest dollar)

✍

Signature of Principal Officer or Chief Accounting Officer or Preparer Other Than Taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1