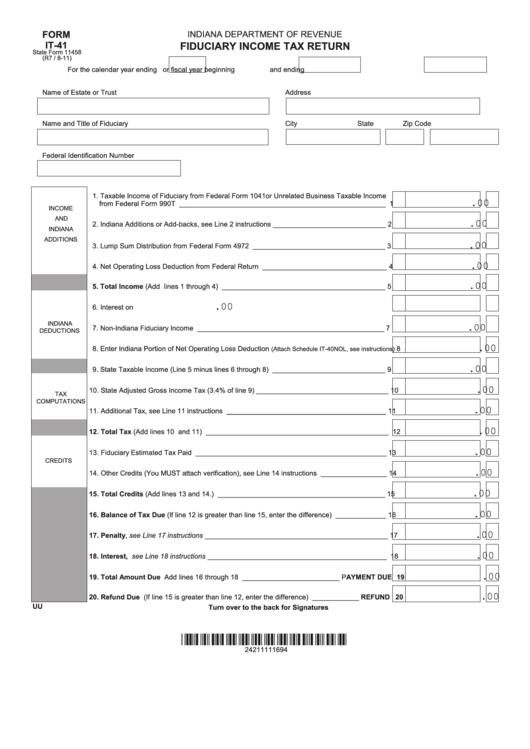

FORM

INDIANA DEPARTMENT OF REVENUE

IT-41

FIDUCIARY INCOME TAX RETURN

State Form 11458

(R7 / 8-11)

For the calendar year ending

or fiscal year beginning

and ending

Name of Estate or Trust

Address

Name and Title of Fiduciary

City

State

Zip Code

Federal Identification Number

1. Taxable Income of Fiduciary from Federal Form 1041or Unrelated Business Taxable Income

.00

from Federal Form 990T _____________________________________________________

1

INCOME

AND

.00

2. Indiana Additions or Add-backs, see Line 2 instructions _____________________________

2

INDIANA

ADDITIONS

.00

3. Lump Sum Distribution from Federal Form 4972 __________________________________

3

.00

4. Net Operating Loss Deduction from Federal Return ________________________________

4

.00

5. Total Income (Add lines 1 through 4) __________________________________________

5

.00

6. Interest on U.S. Obligations Reported on Federal Return ___________________________

6

INDIANA

.00

7. Non-Indiana Fiduciary Income ________________________________________________

7

DEDUCTIONS

.00

8. Enter Indiana Portion of Net Operating Loss Deduction

8

(Attach Schedule IT-40NOL, see instructions)

.00

9. State Taxable Income (Line 5 minus lines 6 through 8) _____________________________

9

.00

10. State Adjusted Gross Income Tax (3.4% of line 9) __________________________________

10

TAX

COMPUTATIONS

.00

11. Additional Tax, see Line 11 instructions _________________________________________

11

.00

12. Total Tax (Add lines 10 and 11) _______________________________________________

12

.00

13. Fiduciary Estimated Tax Paid _________________________________________________

13

CREDITS

.00

14. Other Credits (You MUST attach verification), see Line 14 instructions _________________

14

.00

15. Total Credits (Add lines 13 and 14.) ___________________________________________

15

.00

16. Balance of Tax Due (If line 12 is greater than line 15, enter the difference) _____________

16

.00

17. Penalty, see Line 17 instructions _______________________________________________

17

.00

18. Interest, see Line 18 instructions ______________________________________________

18

.00

19. Total Amount Due Add lines 16 through 18 _________________________ PAYMENT DUE 19

.00

20. Refund Due (If line 15 is greater than line 12, enter the difference) ____________ REFUND 20

UU

Turn over to the back for Signatures

*24211111694*

24211111694

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10