Form Nc-3x - Amended Annual Withholding Reconciliation - North Carolina Department Of Revenue

ADVERTISEMENT

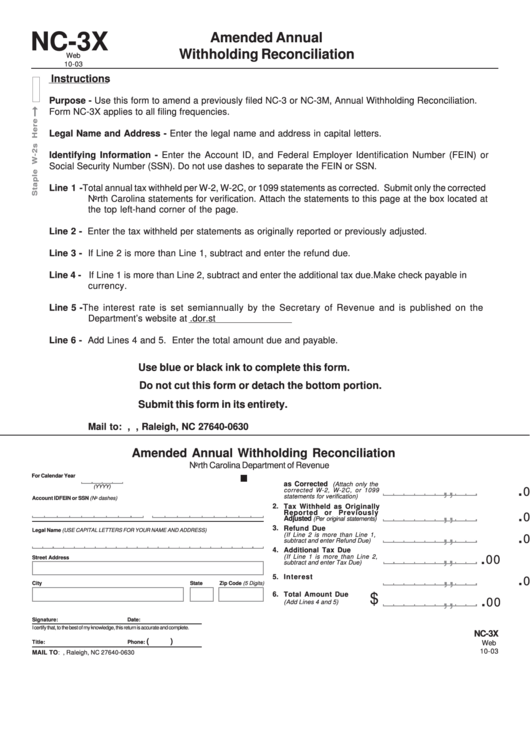

NC-3X

Amended Annual

Withholding Reconciliation

Web

10-03

Instructions

Purpose - Use this form to amend a previously filed NC-3 or NC-3M, Annual Withholding Reconciliation.

Form NC-3X applies to all filing frequencies.

Legal Name and Address - Enter the legal name and address in capital letters.

Identifying Information - Enter the Account ID, and Federal Employer Identification Number (FEIN) or

Social Security Number (SSN). Do not use dashes to separate the FEIN or SSN.

Line 1 - Total annual tax withheld per W-2, W-2C, or 1099 statements as corrected. Submit only the corrected

North Carolina statements for verification. Attach the statements to this page at the box located at

the top left-hand corner of the page.

Line 2 - Enter the tax withheld per statements as originally reported or previously adjusted.

Line 3 - If Line 2 is more than Line 1, subtract and enter the refund due.

Line 4 - If Line 1 is more than Line 2, subtract and enter the additional tax due. Make check payable in U.S.

currency.

Line 5 - The interest rate is set semiannually by the Secretary of Revenue and is published on the

Department’s website at

Line 6 - Add Lines 4 and 5. Enter the total amount due and payable.

Use blue or black ink to complete this form.

Do not cut this form or detach the bottom portion.

Submit this form in its entirety.

Mail to: N.C. Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0630

Amended Annual Withholding Reconciliation

North Carolina Department of Revenue

For Calendar Year

1. Total Annual Tax Withheld

,

,

.

as Corrected

(Attach only the

(YYYY)

00

corrected W-2, W-2C, or 1099

statements for verification)

Account ID

FEIN or SSN (No dashes)

2.

Tax Withheld as Originally

,

,

.

Reported or Previously

00

Adjusted

(Per original statements)

3.

Refund Due

,

,

Legal Name (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

.

(If Line 2 is more than Line 1,

00

subtract and enter Refund Due)

4.

Additional Tax Due

,

,

.

(If Line 1 is more than Line 2,

00

Street Address

subtract and enter Tax Due)

,

,

.

Interest

5.

00

City

State

Zip Code (5 Digits)

,

,

6.

Total Amount Due

.

$

00

(Add Lines 4 and 5)

Signature:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

NC-3X

(

)

Title:

Phone:

Web

10-03

MAIL TO: P.O. Box 25000, Raleigh, NC 27640-0630

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1