Form Dp-145 - Legacy And Succession Tax Return

ADVERTISEMENT

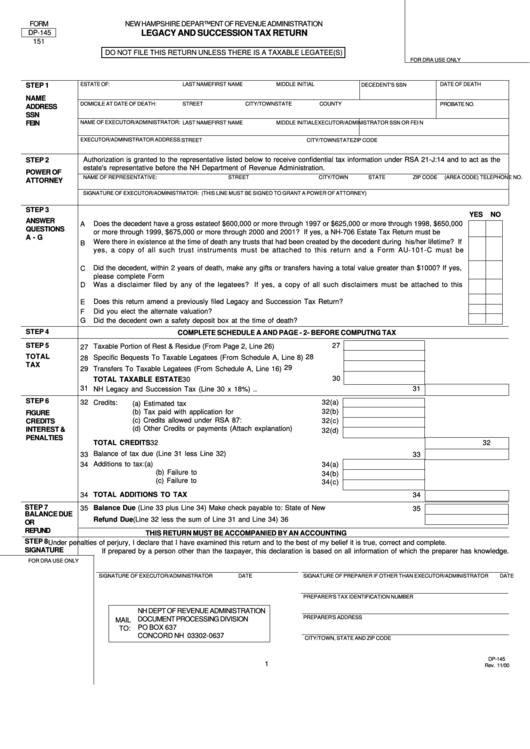

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

LEGACY AND SUCCESSION TAX RETURN

DP-145

151

DO NOT FILE THIS RETURN UNLESS THERE IS A TAXABLE LEGATEE(S)

FOR DRA USE ONLY

ESTATE OF:

LAST NAME

FIRST NAME

MIDDLE INITIAL

DATE OF DEATH

STEP 1

DECEDENT'S SSN

NAME

DOMICILE AT DATE OF DEATH:

STREET

CITY/TOWN

STATE

COUNTY

PROBATE NO.

ADDRESS

SSN

FEIN

NAME OF EXECUTOR/ADMINISTRATOR:

LAST NAME

FIRST NAME

MIDDLE INITIAL

EXECUTOR/ADMINISTRATOR SSN OR FEI N

EXECUTOR/ADMINISTRATOR ADDRESS: STREET

CITY/TOWN

STATE

ZIP CODE

Authorization is granted to the representative listed below to receive confidential tax information under RSA 21-J:14 and to act as the

STEP 2

estate's representative before the NH Department of Revenue Administration.

POWER OF

NAME OF REPRESENTATIVE:

STREET

CITY/TOWN

STATE

ZIP CODE

(AREA CODE) TELEPHONE NO.

ATTORNEY

SIGNATURE OF EXECUTOR/ADMINISTRATOR: (THIS LINE MUST BE SIGNED TO GRANT A POWER OF ATTORNEY)

STEP 3

YES NO

ANSWER

A

Does the decedent have a gross estate of $600,000 or more through 1997 or $625,000 or more through 1998, $650,000

QUESTIONS

or more through 1999, $675,000 or more through 2000 and 2001? If yes, a NH-706 Estate Tax Return must be filed.....

A - G

Were there in existence at the time of death any trusts that had been created by the decedent during his/her lifetime? If

B

yes, a copy of all such trust instruments must be attached to this return and a Form AU-101-C must be

completed.............................................................................................................................................................................

Did the decedent, within 2 years of death, make any gifts or transfers having a total value greater than $1000? If yes,

C

please complete Form AU-101-B...........................................................................................................................................

D

Was a disclaimer filed by any of the legatees? If yes, a copy of all such disclaimers must be attached to this

return....................................................................................................................................................................................

Does this return amend a previously filed Legacy and Succession Tax Return?...............................................................

E

Did you elect the alternate valuation? .................................................................................................................................

F

G

Did the decedent own a safety deposit box at the time of death?......................................................................................

STEP 4

COMPLETE SCHEDULE A AND PAGE - 2- BEFORE COMPUTNG TAX

STEP 5

27

Taxable Portion of Rest & Residue (From Page 2, Line 26)..............................

27

TOTAL

28 Specific Bequests To Taxable Legatees (From Schedule A, Line 8)............... 28

TAX

29 Transfers To Taxable Legatees (From Schedule A, Line 16)........................... 29

30

30

TOTAL TAXABLE ESTATE..............................................................................

31

31

NH Legacy and Succession Tax (Line 30 x 18%).....................................................................................

STEP 6

32

32(a)

Credits:

(a) Estimated tax paid..............................................................

(b) Tax paid with application for extension.............................

32(b)

FIGURE

(c) Credits allowed under RSA 87:1.......................................

32(c)

CREDITS

(d) Other Credits or payments (Attach explanation)...............

INTEREST &

32(d)

PENALTIES

32

TOTAL CREDITS.......................................................................................................................................

32

Balance of tax due (Line 31 less Line 32).................................................................................................

33

33

Additions to tax:

(a) Interest...................................................................

34

34(a)

(b) Failure to pay.........................................................

34(b)

(c) Failure to file..........................................................

34(c)

34

TOTAL ADDITIONS TO TAX.....................................................................................................................

34

STEP 7

Balance Due (Line 33 plus Line 34) Make check payable to: State of New Hampshire..........................

35

35

BALANCE DUE

36

Refund Due (Line 32 less the sum of Line 31 and Line 34)....................................................................

36

OR

REFUND

THIS RETURN MUST BE ACCOMPANIED BY AN ACCOUNTING

STEP 8

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete.

SIGNATURE

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

FOR DRA USE ONLY

SIGNATURE OF EXECUTOR/ADMINISTRATOR

DATE

SIGNATURE OF PREPARER IF OTHER THAN EXECUTOR/ADMINISTRATOR

DATE

PREPARER'S TAX IDENTIFICATION NUMBER

NH DEPT OF REVENUE ADMINISTRATION

PREPARER'S ADDRESS

DOCUMENT PROCESSING DIVISION

MAIL

PO BOX 637

TO:

CONCORD NH 03302-0637

CITY/TOWN, STATE AND ZIP CODE

DP-145

1

Rev. 11/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3