Form Dp-148 - Application For 6-Month Extension Of Time To File Legacy And Succession Tax Return

ADVERTISEMENT

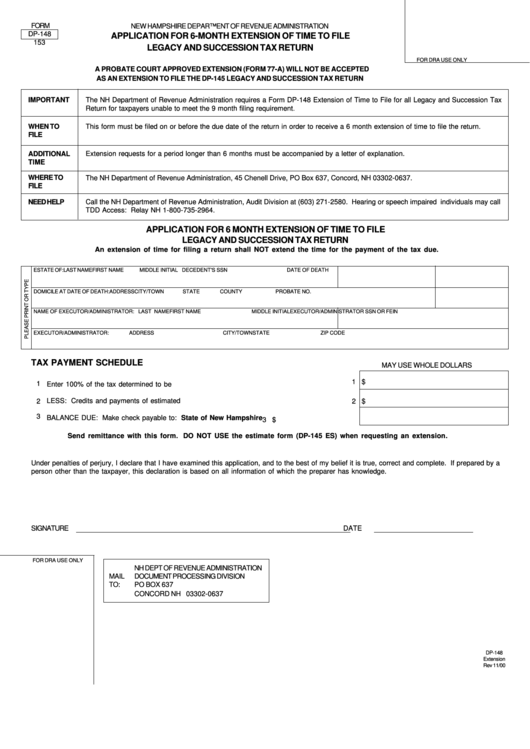

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-148

APPLICATION FOR 6-MONTH EXTENSION OF TIME TO FILE

153

LEGACY AND SUCCESSION TAX RETURN

FOR DRA USE ONLY

A PROBATE COURT APPROVED EXTENSION (FORM 77-A) WILL NOT BE ACCEPTED

AS AN EXTENSION TO FILE THE DP-145 LEGACY AND SUCCESSION TAX RETURN

IMPORTANT

The NH Department of Revenue Administration requires a Form DP-148 Extension of Time to File for all Legacy and Succession Tax

Return for taxpayers unable to meet the 9 month filing requirement.

WHEN TO

This form must be filed on or before the due date of the return in order to receive a 6 month extension of time to file the return.

FILE

ADDITIONAL

Extension requests for a period longer than 6 months must be accompanied by a letter of explanation.

TIME

WHERE TO

The NH Department of Revenue Administration, 45 Chenell Drive, PO Box 637, Concord, NH 03302-0637.

FILE

NEED HELP

Call the NH Department of Revenue Administration, Audit Division at (603) 271-2580. Hearing or speech impaired individuals may call

TDD Access: Relay NH 1-800-735-2964.

APPLICATION FOR 6 MONTH EXTENSION OF TIME TO FILE

LEGACY AND SUCCESSION TAX RETURN

An extension of time for filing a return shall NOT extend the time for the payment of the tax due.

ESTATE OF:

LAST NAME

FIRST NAME

MIDDLE INITIAL DECEDENT'S SSN

DATE OF DEATH

DOMICILE AT DATE OF DEATH:

ADDRESS

CITY/TOWN

STATE

COUNTY

PROBATE NO.

NAME OF EXECUTOR/ADMINISTRATOR: LAST NAME

FIRST NAME

MIDDLE INITIAL

EXECUTOR/ADMINISTRATOR SSN OR FEIN

EXECUTOR/ADMINISTRATOR:

ADDRESS

CITY/TOWN

STATE

ZIP CODE

TAX PAYMENT SCHEDULE

MAY USE WHOLE DOLLARS

1 $

1

Enter 100% of the tax determined to be due.............................................................................

2

LESS: Credits and payments of estimated tax........................................................................

2 $

3

BALANCE DUE: Make check payable to: State of New Hampshire..................................

3 $

Send remittance with this form. DO NOT USE the estimate form (DP-145 ES) when requesting an extension.

Under penalties of perjury, I declare that I have examined this application, and to the best of my belief it is true, correct and complete. If prepared by a

person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

SIGNATURE

DATE

FOR DRA USE ONLY

NH DEPT OF REVENUE ADMINISTRATION

MAIL

DOCUMENT PROCESSING DIVISION

TO:

PO BOX 637

CONCORD NH 03302-0637

DP-148

Extension

Rev 11/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1