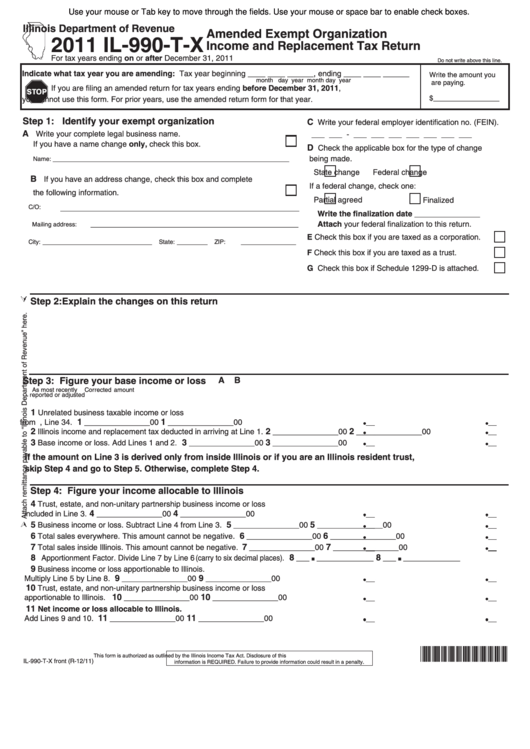

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Amended Exempt Organization

2011 IL-990-T-X

Income and Replacement Tax Return

For tax years ending on or after December 31, 2011

Do not write above this line.

Indicate what tax year you are amending: Tax year beginning ____ ____ ______, ending ____ ____ ______

Write the amount you

month day

year

month

day

year

are paying.

If you are filing an amended return for tax years ending before December 31, 2011,

$_________________

you cannot use this form. For prior years, use the amended return form for that year.

Step 1: Identify your exempt organization

C

Write your federal employer identification no. (FEIN).

A

Write your complete legal business name.

___ ___ - ___ ___ ___ ___ ___ ___ ___

If you have a name change only, check this box.

D

Check the applicable box for the type of change

______________________________________________________

being made.

Name:

State change

Federal change

B

If you have an address change, check this box and complete

If a federal change, check one:

the following information.

Partial agreed

Finalized

______________________________________________________

C/O:

Write the finalization date _______________

_______________________________________________

Attach your federal finalization to this return.

Mailing address:

E Check this box if you are taxed as a corporation.

_________________________

_______

____________

City:

State:

ZIP:

F Check this box if you are taxed as a trust.

G Check this box if Schedule 1299-D is attached.

Step 2: Explain the changes on this return

Step 3: Figure your base income or loss

A

B

As most recently

Corrected amount

reported or adjusted

1

Unrelated business taxable income or loss

1

1

from U.S. Form 990-T, Line 34.

_______________ 00

_______________ 00

2

2

2

Illinois income and replacement tax deducted in arriving at Line 1.

_______________ 00

_______________ 00

3

3

3

Base income or loss. Add Lines 1 and 2.

_______________ 00

_______________ 00

If the amount on Line 3 is derived only from inside Illinois or if you are an Illinois resident trust,

skip Step 4 and go to Step 5. Otherwise, complete Step 4.

Step 4: Figure your income allocable to Illinois

4

Trust, estate, and non-unitary partnership business income or loss

4

4

included in Line 3.

_______________ 00

_______________ 00

5

5

5

Business income or loss. Subtract Line 4 from Line 3.

_______________ 00

_______________ 00

6

6

6

Total sales everywhere. This amount cannot be negative.

_______________ 00

_______________ 00

.

.

7

7

7

Total sales inside Illinois. This amount cannot be negative.

_______________ 00

_______________ 00

8

8

8

Apportionment Factor. Divide Line 7 by Line 6 (carry to six decimal places).

___

_____________

___

_____________

9

Business income or loss apportionable to Illinois.

9

9

Multiply Line 5 by Line 8.

_______________ 00

_______________ 00

10

Trust, estate, and non-unitary partnership business income or loss

10

10

apportionable to Illinois.

_______________ 00

_______________ 00

11

Net income or loss allocable to Illinois.

11

11

Add Lines 9 and 10.

_______________ 00

_______________ 00

*131801110*

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

IL-990-T-X front (R-12/11)

information is REQUIRED. Failure to provide information could result in a penalty.

1

1 2

2