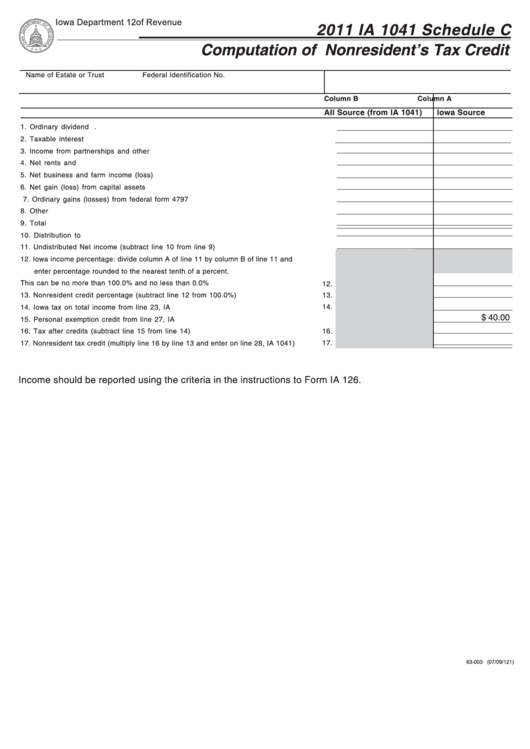

Iowa Department 12of Revenue

2011 IA 1041 Schedule C

Computation of Nonresident’s Tax Credit

Name of Estate or Trust

Federal Identification No.

Column B

Column A

All Source (from IA 1041)

Iowa Source

1. Ordinary dividend income................................................................................................. 1.

2. Taxable interest income................................................................................................... 2.

3. Income from partnerships and other fiduciaries................................................................. 3.

4. Net rents and royalties..................................................................................................... 4.

5. Net business and farm income (loss) ............................................................................... 5.

6. Net gain (loss) from capital assets ................................................................................... 6.

7. Ordinary gains (losses) from federal form 4797 .................................................................. 7.

8. Other income................................................................................................................... 8.

9. Total income.................................................................................................................... 9.

10. Distribution to beneficiaries.............................................................................................10.

11. Undistributed Net income (subtract line 10 from line 9).....................................................11.

12. Iowa income percentage: divide column A of line 11 by column B of line 11 and

enter percentage rounded to the nearest tenth of a percent.

This can be no more than 100.0% and no less than 0.0% ..............................................

12.

13. Nonresident credit percentage (subtract line 12 from 100.0%) ........................................

13.

14.

14. Iowa tax on total income from line 23, IA 1041................................................................

$ 40.00

15. Personal exemption credit from line 27, IA 1041............................................................. 15.

16. Tax after credits (subtract line 15 from line 14)...............................................................

16.

17.

17. Nonresident tax credit (multiply line 16 by line 13 and enter on line 28, IA 1041).............

Income should be reported using the criteria in the instructions to Form IA 126.

63-003 (07/09/121)

1

1