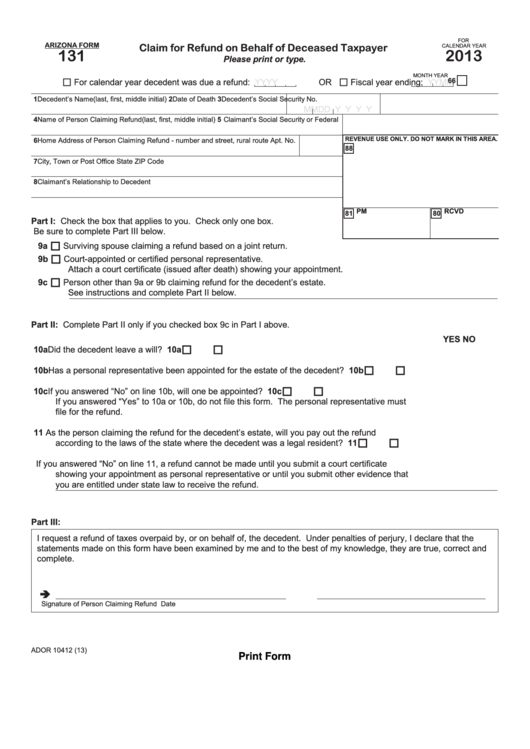

FOR

ARIZONA FORM

Claim for Refund on Behalf of Deceased Taxpayer

CALENDAR YEAR

131

2013

Please print or type.

MONTH YEAR

66

For calendar year decedent was due a refund:

OR

Fiscal year ending:

Y

Y

Y

Y

M

M

Y

Y

1 Decedent’s Name (last, first, middle initial)

2 Date of Death

3 Decedent’s Social Security No.

M

M

D D Y Y Y Y

4 Name of Person Claiming Refund (last, first, middle initial)

5 Claimant’s Social Security or Federal I.D. No.

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

6 Home Address of Person Claiming Refund - number and street, rural route

Apt. No.

88

7 City, Town or Post Office

State

ZIP Code

8 Claimant’s Relationship to Decedent

81 PM

80 RCVD

Part I: Check the box that applies to you. Check only one box.

Be sure to complete Part III below.

9a

Surviving spouse claiming a refund based on a joint return.

9b

Court-appointed or certified personal representative.

Attach a court certificate (issued after death) showing your appointment.

9c

Person other than 9a or 9b claiming refund for the decedent’s estate.

See instructions and complete Part II below.

Part II: Complete Part II only if you checked box 9c in Part I above.

YES

NO

10a Did the decedent leave a will? ......................................................................................................

10a

10b Has a personal representative been appointed for the estate of the decedent? ..........................

10b

10c If you answered “No” on line 10b, will one be appointed? ............................................................

10c

If you answered “Yes” to 10a or 10b, do not file this form. The personal representative must

file for the refund.

11

As the person claiming the refund for the decedent’s estate, will you pay out the refund

according to the laws of the state where the decedent was a legal resident? ..............................

11

If you answered “No” on line 11, a refund cannot be made until you submit a court certificate

showing your appointment as personal representative or until you submit other evidence that

you are entitled under state law to receive the refund.

Part III:

I request a refund of taxes overpaid by, or on behalf of, the decedent. Under penalties of perjury, I declare that the

statements made on this form have been examined by me and to the best of my knowledge, they are true, correct and

complete.

Signature of Person Claiming Refund

Date

ADOR 10412 (13)

Print Form

1

1